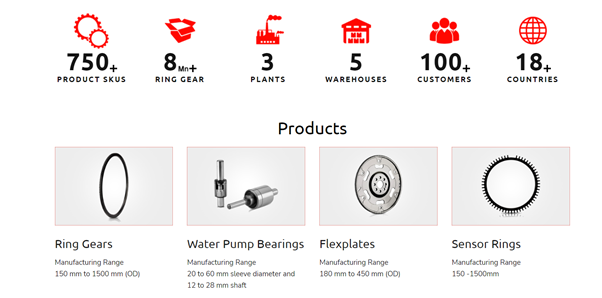

Ring Plus Aqua – better known as RPAL. Its primarily involved in manufacturing business and exporting ring gears, flex plates, water pump bearings, machined components both for auto component and engineering products. JK Files & Engineering Limited, which is part of the Raymond Group, is the holding company of RPAL holding 89.07% capital of the firm.

The Gross Revenue for the fiscal year 2023 stood at INR 378.47 crores whereas in the previous year it was accounted for INR 324.32 crores. During the same time, it made profit before tax of Rs. 51.81 crores and made a remarkable profit of INR 39.11 crores.

Overseas income contribution varies from (40% -48%) depending upon the order size and FX values between the trading countries. It also brings exposure to risk associated with volatility of foreign exchange and interest rates.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 |

|---|---|---|---|---|---|---|---|

| Total Income | 378.47 | 324.32 | 203.78 | 211.65 | 262.04 | 210.07 | 160.17 |

| PBT | 51.81 | 51.58 | 28.58 | 25.37 | 50.43 | 35.79 | 10.49 |

| PAT | 39.11 | 38.73 | 22.52 | 17.98 | 36.17 | 26.39 | 7.71 |

| Cash Flow from Operations | 40.64 | 38.88 | 34.66 | 39.85 | 36.61 | 34.85 | 30.74 |

| Cash Flow from Investing | -34.91 | 38.05 | -34.18 | -36.4 | -34.69 | -5.72 | 9.43 |

| Cash Flow from Financing | -2.08 | -73.91 | -2.8 | 0.26 | -3.36 | -27.85 | -43.37 |

| Debt to Equity | 0.04 | 0.08 | 0.07 | 0.1 | 0.11 | 0.19 | 0.78 |

| Current Ratio | 1.76 | 1.50 | 1.88 | 1.64 | 1.32 | 1.25 | 0.88 |

| EPS | 49.8 | 49.24 | 29.03 | 23.18 | 46.63 | 34.02 | 9.94 |

RPAL has started pilot supplies of new products and has increased its product portfolio. Its revenue is generated by teaming up with other firms and getting a contract. Apart from that getting incentive while exporting and selling of process waste generates good amount of revenue for the firm. On a hindsight of strong initiatives on increasing share of business with existing customers and new business development, it has strong hold on customers from domestic and foreign markets. It already started ramping up its resources and geared up to meet this demand and has taken up capacity expansion projects for both ring gears and water pump bearings. It continued its focus on operational excellence, relentless cost reduction measures, lean manufacturing practices, and improvised supply chain management with tight control on working capital using new tech like IOT based monitoring system, high speed digital multi gauge. These measures supported them in mitigating the impact on the margins and improving their cash flows. The global surge in automotive demand for passenger and commercial vehicles will be helpful in enhancing the growth of the firm.

The Company’s ring gear product is a success and generates three times more revenue than their other products (pump bearing, flex plates & others). Apart from the domestic market, America is a major market for the firm followed by different parts of Europe, Asia & Latin America. This brings up the risk factor very much on the cards, considering the fluctuations in FX, commodity prices, interest rates, compliance issues, etc. To mitigate & take coercive action against the risks, RPAL regularly monitors and assesses things on a regular basis.

Ravikant Uppal – Chairman

Balasubramanian V - CEO

Manish Kothari – CFO

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111