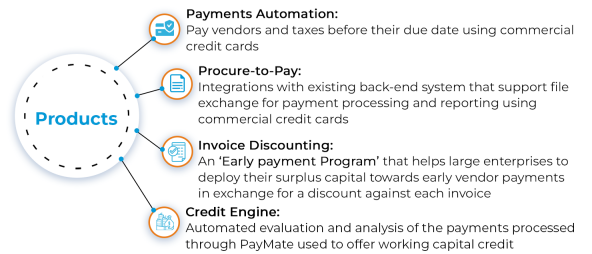

PayMate (incorporated in India) is a leading provider in B2B payments for Enterprise and SME’s. Paymate platform is an integrated platform which includes multiple payment categories, providing a fully integrated B2B payments stack (vendor payment, invoicing, GST, reconciliation) along with lending facilities to their customers.

PayMate has developed partnerships with banks and financial institutions like ICICI Bank Ltd, SBI Cards and other leading private bank in India that account for 50% of all credit cards issued in India.

It has strong presence with total customer & user base of 2,11,886 & dealt with total processing volume worth of INR 699,099.6 million.

PayMate works with leading Visa commercial card-issuing banks to facilitate credit for both payables and receivables across supply chains. Visa holds ~3% stake in PayMate.

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|

| TPV | 84,519 | 69,918.00 | 22,141.93 | 19,764.43 | 21,030.69 |

| Total Income | 1,351.59 | 1,209.22 | 349.02 | 217.36 | 236.04 |

| Gross Profit | 11.1 | 1.4 | -0.1 | -4.46 | 5.38 |

| PAT | -55.7 | -57.74 | -28.11 | -27.77 | -7.96 |

| EPS | -9.69 | -10.65 | -5.41 | -5.41 | -1.58 |

| Cash Flow from Operations | -13.5 | -61.84 | -12.83 | -39.11 | -7.23 |

| Cash Flow from Investing | 0.2 | 0.6 | 5.68 | -13.12 | -1.23 |

| Cash Flow from Finance | 12.4 | 62.08 | -0.51 | 62.09 | 8.15 |

| Particulars | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24E | Mar-25E |

|---|---|---|---|---|---|---|---|

| TPV | 21,030.69 | 19,764.43 | 22,141.93 | 69,918.00 | 84,519.00 | 1,10,375.00 | 1,35,761.00 |

| Revenue | 236.04 | 217.36 | 349.02 | 1,209.22 | 1,351.00 | 1,722.00 | 2,142.00 |

| EBITDA | -6.91 | -24.95 | -25.6 | -24.4 | -30.5 | 3.7 | 61.9 |

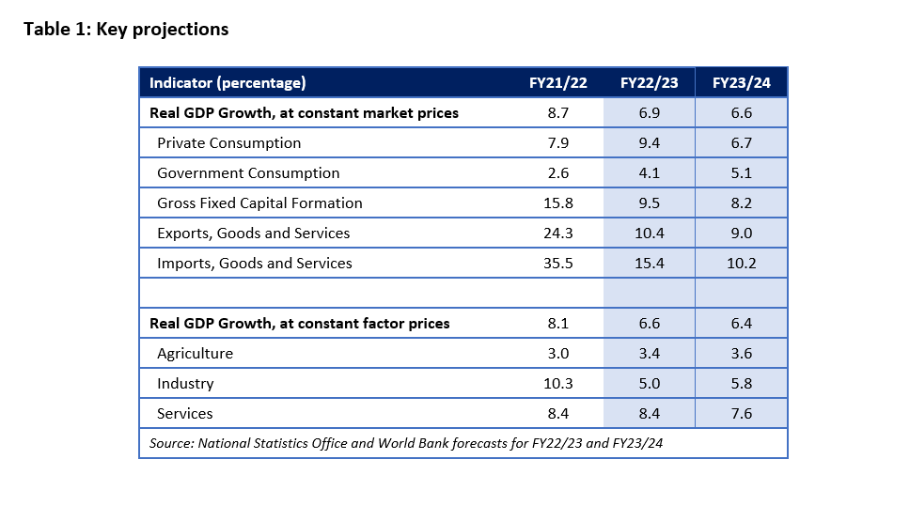

The company has shown tremendous growth post pandemic with top-line reflecting more than INR 1200 (crore) & expected to grow further due to multiple reasons (India’s growth rate- 6.6, Govt push for digitalization & manufacturing sector, ease of lending & other services provided by PayMate). The firm invested heavily on automation during initial days to provide better service to its consumers & is committed to do so in future by minimizing the operational cost. Which is evident enough from their rapid growth and projections & soon will be reflected in their bottom line i.e., net profit in upcoming quarters. Revenues generated from the subscription-based model apart from cross border transaction, service & transaction charge pumps in huge revenue for the firm.

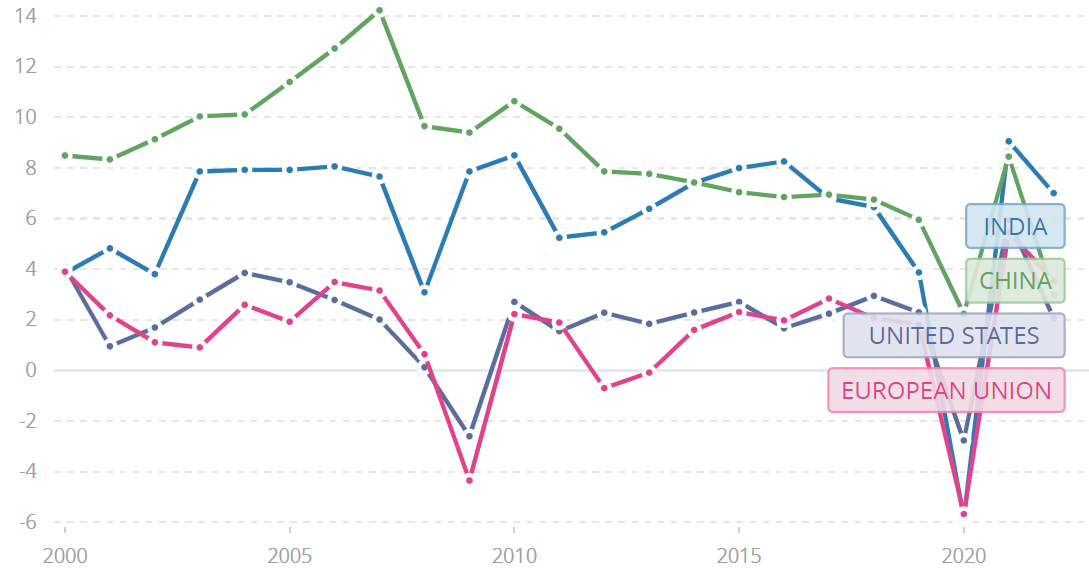

Indian economy is witnessing an immense growth and heading towards USD 5 trillion mark by 2027. Currently, it is hovering around USD 3.5 trillion & as per latest update India’s GDP grew by 6.1% in the fourth quarter of 2022-23 to raise the yearly growth rate to 7.2 percent.

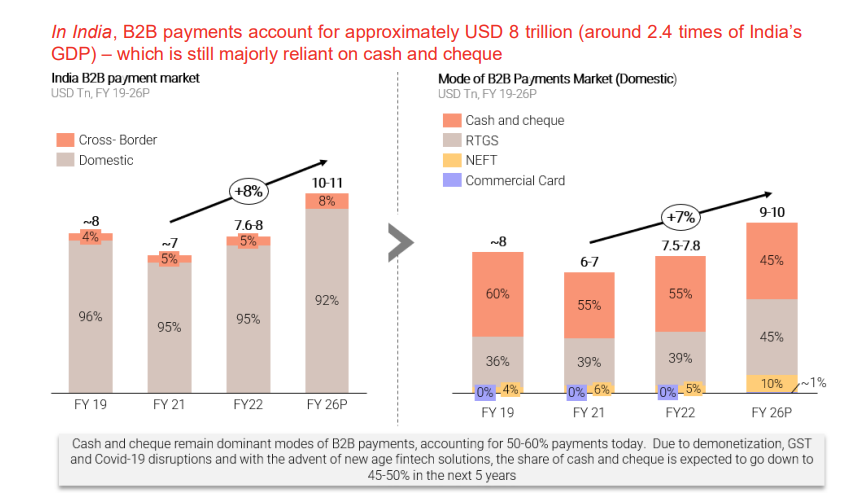

Major contribution from service sector (BFSI, IT industry) in the overall growth of Indian economy and government focus & investment towards manufacturing sector (infrastructure & MSME’s) will shrink the gap between these two sector & create a massive opportunity for fintech firms like Paymate. As there are close to 80 million MSME’s & as many vendors operating in India which do B2B transactions on a recurring basis but use different mode or channel (cash, cheque, DD etc) due to lack of options, can be overcome by Paymate.

VISA & Venture Capitalist (Mayfield, Brand Capital, Lightbox etc)

Ajay Adiseshan, Probir Kumar Roy, Dhruv Pratap Singh, Aleaxander Kuruvilla, Uma Viswanathan, CXI Valley I LLC, Bennett Coleman, Rajat Yadav

Ajay Adiseshan- (MD & Chairman)- is a serial entrepreneur with experience in building and leading successful technology companies.

Vishvanathan Subramanian - (CFO & Director)- is a certified Chartered Accountant and also a qualified Cost Accountant.

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111