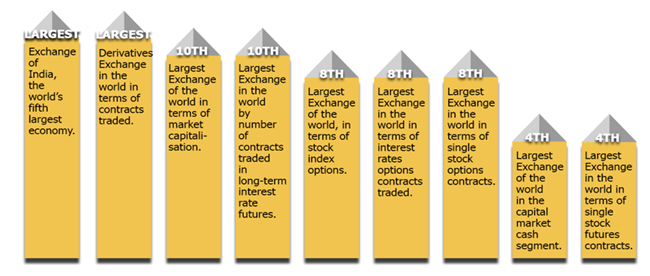

The NSE is India’s largest stock exchange in terms of total, and average daily turnover for equity shares with over 2,000 listed companies. NSE is the preferred designated stock exchange for some of the largest Indian companies. It is like an institution & offers one of the most dynamic driven platforms.

Incorporated in 1992, NSE was recognised as a stock exchange by Securities and Exchange Board of India (SEBI) in 1993 and commenced operations in 1994. It offers a platform to companies for raising capital, & investors can access multiple products on their platform. It is also the world’s largest derivatives exchange for the fifth consecutive year in terms of the number of contracts traded.

NSE offers a comprehensive coverage of the Indian capital markets across asset classes. The company’s fully integrated business model comprises of exchange listing, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education offerings. NSE oversees compliances by trading cum clearing members as well as listed companies in line with SEBI and Exchange regulations. Its derivatives market offers trading opportunities in various forms of derivatives, such as futures and options on stocks and indices, currency futures and options, interest rate futures and options and commodities future and options. NSE has 16 (direct and indirect) subsidiaries (14 in India and 2 abroad)

NSE operates in Trading Services, Clearing Services, Data Feed, Index Licensing Fees, Strategic Investment segments. Other segments include end to end solution, e-learning solutions, web trading, T- services, software application development & IT security.

On a consolidated basis, NSE delivered an income of INR12,765 crore in FY23 against INR 9,499 crore for the previous year, a resilient performance despite some operational challenges through the year. It delivered a consolidated profit after tax of INR 7,356 crore against INR 5,108 crore for the previous year. On a standalone basis, NSE delivered Revenue of INR 11,181 crore in FY23 against INR 7,762 crore for the previous year and earnings per share at INR 148.58 per share of face value of INR 1.

Total operating revenue on a consolidated basis for the quarter ended March-FY23 increased by 31% from INR 2,635 crores to INR 3,453 crores as compared to the previous quarter ended March-FY22.

They have witnessed overwhelming growth from adjacent index & data and terminal business. NSE consolidated net worth as on March 31, FY23 stood at INR20,478 crores.

NSE's income from listing services which include listing fees, book building fees, processing fees for the current quarter stood at INR 50 crores, out of which listing fee income was INR29 crores.

NSE has spent INR 258 crores towards technology-related operational expenses including depreciation and amortization.

Major source of revenue comes from following activities: - transactional services, listing services, processing fees, colocation charges, other income etc.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|

| Total Income | 12,765.4 | 9,499.64 | 6,264.41 | 3,897.52 | 3,684.31 |

| PBT | 9,914 | 6,822.01 | 4,399.07 | 2,412.68 | 2,469.18 |

| PAT | 7,356 | 5,108.01 | 3,507.52 | 1,772.21 | 1,601.01 |

| Cash Flow from Operations | 1,734.49 | 5,831.69 | 2,904.26 | 3,627.63 | 1,687.98 |

| Cash Flow from Investing | 3,217.04 | -4,185.27 | -2,402.33 | 178.06 | -401.81 |

| Cash Flow from Finance | 2,099.98 | -1,258.31 | -570.76 | -1,083.63 | -1,014.47 |

| Dividend Per Share | 80 | 42.00 | 24.75 | 20.80 | 17.25 |

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|

| Current Ratio | 2.13 | 1.71 | 1.51 | 1.53 | 1.50 |

| Operating Margin | 8916 | 6261.00 | 3915.00 | 2023.00 | 1813.00 |

| Operating Profit% | 75% | 75% | 70% | 58% | 60% |

| Operating EBITDA | 9300 | 6572 | 4141 | 2155 | 1955 |

| Operating EBITDA % | 78% | 79% | 74% | 61% | 65% |

| PAT% | 58% | 59% | 58% | 48% | 49% |

| EPS | 148.58 | 104.95 | 72.20 | 38.08 | 34.51 |

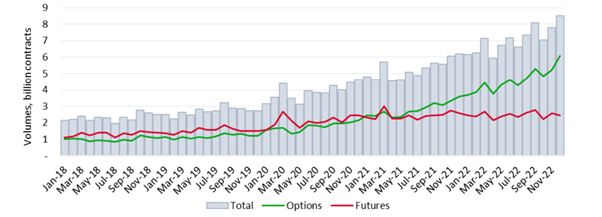

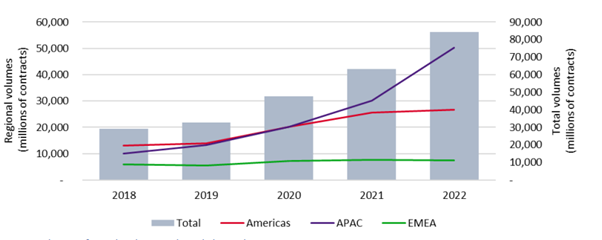

According to the World Federation of Exchange, global derivatives-trading volume went up by 34.4%, which is significant rise. The volume increased by 84.76 billion for derivative contracts traded. Out of this 56.17 billion were for option and 29.59 billion for futures. However, the APAC region dominated the volume figures, where 50.32 billion contracts were traded, followed by America, with 26.84 billion while rest was added by EMEA region with 7.60 billion. India secured the top place, and it is known for the largest derivative market by volume & has been witnessing enormous growth since last decade.

Indian economy is witnessing an immense growth and heading towards USD 5 trillion mark by 2027. Currently, it is hovering around USD 3.5 trillion economy & as per latest update India’s GDP grew by 6.1% in the fourth quarter of 2022-23 to raise the yearly growth rate to 7.2 percent. NSE maintained its leadership position in domestic markets with a 93% market share in the Capital Market segment and near-100% share in the Equity Derivatives segment. Market share in the Currency Options segment moved up nearly eight points higher to 95%, while that in the Currency Futures segment remained robust at 70%.

| Derivatives | Total | Volume: |

|---|

TCS, Oracle, VMware, Airtel, NASDAQ, WIPRO, IBM, ServiceNow, CISCO.

NSE Clearing Limited (NCL): - It is a clearing corporation & settlement house.

NSE Indices Limited (NSE Indices): - It provides a variety of indices and index related services and products.

NSE Investments Limited (NSEI): - it was incorporated for all strategic investments in the equity shares or other securities of NSE group companies.

NSE InfoTech Services Limited (NSE InfoTech), NSEIT Limited (NSEIT), NSE Data & Analytics Limited (NDAL), NSE Academy Limited (NAL), NSE IFSC Limited (NSE IFSC), NSE IFSC Clearing Corporation Limited (NICCL), NSE Foundation, Aujas Cybersecurity Limited (Aujas), Talentsprint Private Limited, Cogencis Information Services Limited, CXIO Technologies Private Limited (CXIO), TalentSprint Inc, NSEIT (US) Inc. (NSEIT US) are the other subsidiaries of NSE.

Regional Office based out in Mumbai, Kolkata, Delhi, Chennai & Ahmedabad. NSE has 25 locations where business is undertaken including offices in Indore, Kanpur, Pune, Jaipur, Cochin, Hyderabad, Bangalore, Patna, Lucknow, Vadodara, Raipur, Jammu, Shimla, Panji, Ranchi, Guwahati, Chandigarh, Bhubaneshwar & Dehradun.

Life Insurance Corporation of India (10.72%), Aranda Investments (Mauritius) Pte Ltd (5%), Stock Holding Corporation of India Ltd (4.44%), SBI Capital Markets Limited (4.33%), Veracity Investments Limited (3.93%), State Bank of India (3.23%), Crown Capital Limited (3.17%), PI Opportunities Fund I (3%), MS Strategic (Mauritius) Limited (2.62%), Acacia Banyan Partners (2.50%)

Mr. Girish Chandra Chaturvedi -Chairman

Mr. A K Chauhan – MD & CEO

Mr. Yatrik Vin – CFO

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111