Kannur International Airport is the second greenfield airport setup in the public private partnership model in the civil aviation infrastructure sector in Kerala. It was commissioned on 9 December 2018, and it is the 4th international airport in Kerala, the only State in the country to have 4 international airports.

The strategic location of the airport makes it viable to transform it into an air cargo hub for the North Malabar region. This region is very popular amongst tourists and has become a major crowd puller (domestic & international) due to its landscape, pilgrimage sites & health infrastructure.

| Description | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

|---|---|---|---|---|---|---|

| Revenue from Operations | 11,265.93 | 7,831.00 | 4477.06 | 11589.8 | 1500.98 | 42 |

| PBT | -14,481.23 | -13,826.67 | -17936.80 | -10886.00 | -7890.97 | -990.68 |

| PAT | -12,627.14 | -12,430.24 | -18,499.70 | -9503.86 | -4696.26 | -990.68 |

| EPS | -9.43 | -9.29 | -13.83 | -7.37 | -4.28 | -0.99 |

The severe impact of the lockdown faced by the firm during the period of 2020-21 was reflected in the performance of the firm. Where revenue has taken a dip by almost three times from FY20 to register INR 44.77 crore. Also, the net loss for FY21 was INR 185 crore from the previous year’s net loss of INR 95 crore.

| Year | Int Passengers | Domestic Passengers | Total Passengers |

|---|---|---|---|

| 2018-19 | 92,008 | 1,37,586 | 2,29,594 |

| 2019-20 | 8,28,076 | 7,91,647 | 16,19,723 |

| 2020-21 | 3,04,285 | 1,87,238 | 4,91,523 |

| 2021-22 | 5,22,317 | 2,81,119 | 8,03,436 |

| Year | Int. Aircraft | Domestic Aircraft | Total Aircraft |

|---|---|---|---|

| 2018-19 | 577 | 1456 | 2033 |

| 2019-20 | 5385 | 9738 | 15123 |

| 2020-21 | 2320 | 3923 | 6243 |

| 2021-22 | 4120 | 5641 | 9761 |

Note-Go Airlines (India) Limited has filed for insolvency proceedings. It currently serves 12 million passengers per annum. CIAL & all other airports can witness initial dip but eventually substitute carrier absorbing those commuters by different airlines.

Over the next decade, India will grow to have the largest population in the world, its economy will expand the fastest among the G20 nations, and a burgeoning middle class will spend more on air travel. As a result, passenger traffic in India will grow fast and is looking at exponential growth in every facet of the aerospace and aviation ecosystem. India is already the third biggest domestic aviation market in the world and is progressing on the path to take a spot of third biggest aviation market overall. With the demand reaching new horizon & scheme like UDAN (Central Govt) added new routes in domestic market which simultaneously created a buzz in airline industry to add more fleets in their arsenal that will subsequently increase the growth. Apart from that direct international flights from major Gulf cities are playing a crucial role in reshaping of the KIAL.

Currently, Airport Authority India (AAI) leased out eight of its airports under Public Private Partnership (PPP) namely Delhi, Mumbai, Lucknow, Ahmedabad, Mangalore, Jaipur, Guwahati, Cochin & looking forward to lease out twenty-five more as per the report published by Ministry of Civil Aviation over the period of three years between 2022 to 2025.

The Airports Authority of India (AAI) and other airport developers have taken up the development of new and existing airports with a projected capital expenditure of approximately INR 98,000 crore in the next five years. The Union Budget 2023-24 allocated an amount of INR 1,244.07 crore for Regional Connectivity Scheme (UDAN). The National Civil Aviation Policy in another initiative aimed at promoting growth in the aviation sector by providing incentives for the development of airport infrastructure, reducing taxes, and simplifying regulations. With up to 100 percent FDI permitted in Greenfield and existing airport projects and for MRO (maintenance and repair organisations) under the automatic route, India is attracting investors to the sector.

BPCL-KIAL Fuel Farm Pvt Limited is only a joint venture company with BPCL. Kannur Airport holds 26% equity whereas BPCL holds 74% equity.

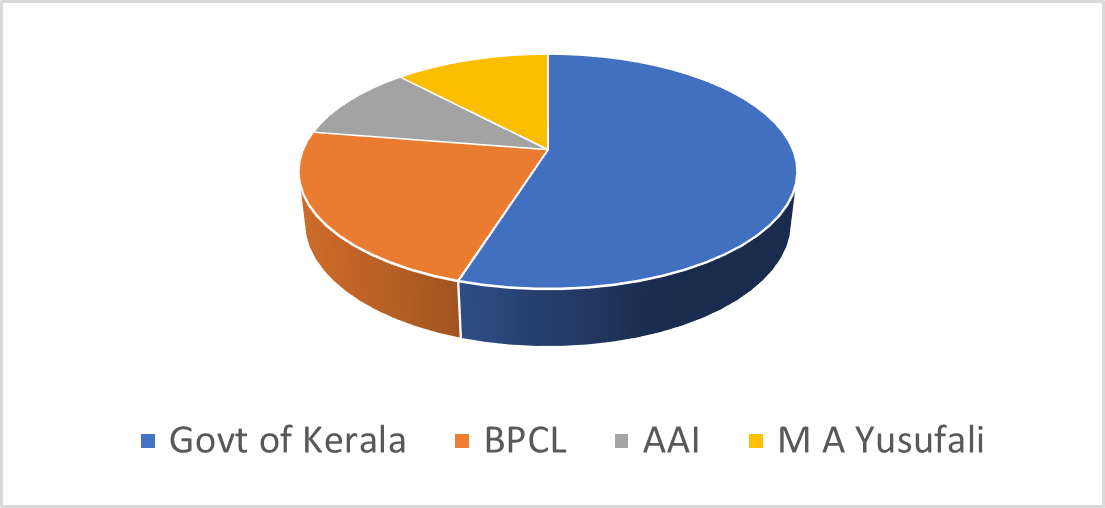

| Shareholders | % of Share |

|---|---|

| Govt of Kerala | 39.23 |

| BPCL | 16.2 |

| AAI | 7.47 |

| M A Yusufali | 8.59 |

Shri. Pinarayi Vijayan– Chairman (Current Chief Minister of Kerala)

Mr. C Dinesh Kumar- Managing Director

Mr. S JayaKrishnan- CFO

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111