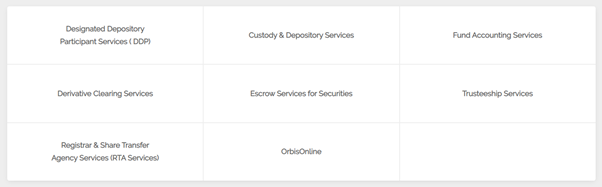

Incorporated in 2005, Orbis Financial Corporation Limited is a financial services company which mostly exhibits & provides expertise and services in inter-related verticals namely custody & fund accounting services, equity and commodity derivatives clearing, currency derivatives clearing, registrar and transfer agency and trustee services. It is a registered as Custodian of Securities and a Clearing member in all the market segments with the most important regulator of securities markets in India - Securities and Exchange Board of India (SEBI).

During FY23, it earned a total income of INR 299.78 crore as compared to INR 191.03 crore in the previous year, recording a growth of 57%. Total expenses during the same time were recorded as INR 177.89 crore as compared to INR 125.80 crore in the previous year, a growth of 41.41%. Orbis manages to earn a PBT of INR 121.89 crore as compared to INR 65.22 crore in FY22, recording an increase of 86.89%. The profit after tax was INR 89.57 crore as compared to INR 47.83 crore in the previous year, a growth of 87.26%.

Asset Under Custody increased by 20% & accounted for a whooping amount of INR 81,160 crore in FY23 from previous year INR 67,369 crore. In FY23, its net worth was accounted for INR 429 crore & total assets registered was INR 5,040 crore.

| Description | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|

| Total Income | 299.78 | 191.03 | 86.53 | 43.87 | 22.45 |

| PBT | 121.89 | 65.22 | 19.5 | 16.34 | 9.04 |

| PAT | 89.57 | 47.83 | 15.93 | 11.5 | 7.21 |

| Debt to Equity | 0.029 | 0.004 | 0.008 | 0.009 | 0.009 |

| Current Ratio | 1.01 | 0.87 | 0.75 | 1.11 | 1.14 |

| EPS | 8.94 | 5.41 | 1.82 | 1.76 | 1.1 |

It has been given a credit rating by ICRA – A, which means stable for its long-term and ICRA A2+ for short term non-fund based facilities amounting to INR 600 crore in FY22. Major source of revenue inflow comes from the sale of services. It provides securities services to foreign institutional investors, domestic institutional investors, corporates and other investors including HNI’s and trusts. The firm has also invested more on long term deposits. It has one subsidiary under the name of Orbis Trusteeship Services Pvt Ltd.

The custody service provider has changed significantly over the period with the substantial changes coming with the introduction of new age technology, newer offerings, globalization and changes in norms. This helped custodians to adapt to it and provide better outcomes by increasing their efficiency & services along with mitigating risk on a timely basis.

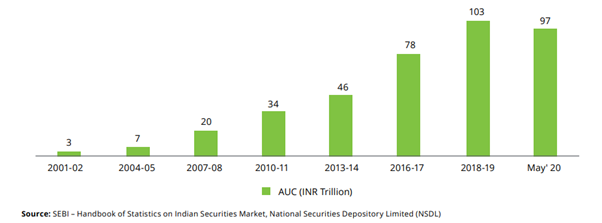

The Indian custody services market has seen rapid growth from the last two decades. The AUC for the Indian market increased 36 times at a CAGR of 22 percent from FY02 (INR 3 trillion) to FY20 (INR 97 trillion). However, the market is still less than 2 percent of the total global custody market. In comparison, India’s share in global GDP is about 3.5 percent, thus implying that the country’s AUC market has a significant room to grow.

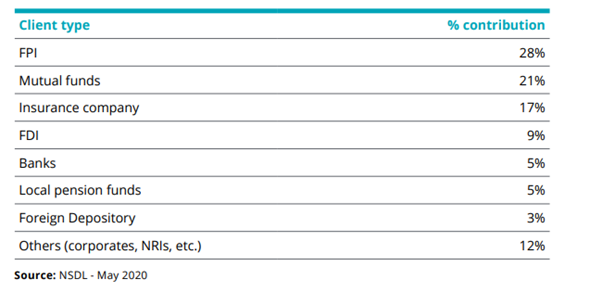

As the Indian capital market matures and attracts investments, its share in the global custody market is expected to increase. A major chunk of contribution comes from the FPI, MF, Insurance company, FDI, Banks, Pension Funds, Foreign Depository & others. The India’s overall growth in the next decade will be major booster for this sector and attract major investor to invest heavily in this part of the world and add more value to its pool & this can be deciphered from the colossal growth of Orbis & its peers in last couple of years.

Atul Gupta, Arpit Khandelwal, Orbis Foundation, Plutus Wealth Management, Multi Act Private Equity Investment Trust,

Full-Service Banks - ICICI, HDFC, Axis, Yes Bank, Kotak Mahindra

Foreign Full- Service Banks - JP Morgan Chase, CITI, BNP Paribas, DBS, HSBC etc

Non-Bank Custodian – Orbis Financial, Edelweiss, SBI – SG Global etc

Atul Gupta – Chairman

Shyam Agarwal – MD & CEO

Rishav Bagrecha – CFO

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111