Cochin Airport (IATA code: COK) is an international airport serving the city of Kochi, India. Cochin International Airport Limited (CIAL) owns and operates the airport, which is one of its kind & was registered as first airport built under Public Private Partnership (PPP) model. Cochin International Airport Limited is a unique entity established with equity participation from the Government of Kerala, NRIs, Industrialists, Financial Institutions and Airport Service Providers, with around 18,000 shareholders from 29 countries.

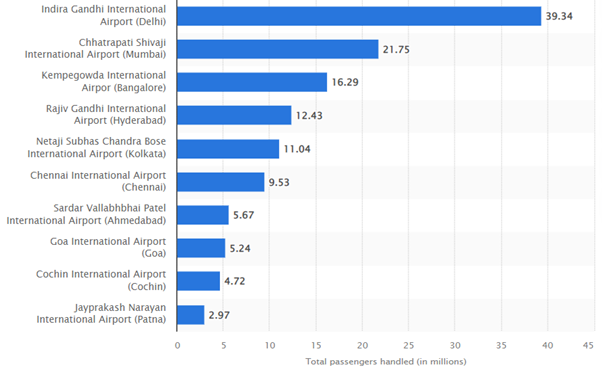

Cochin Airport is located at Nedumbassery, 25km north-east of Cochin, Kerala, the commercial capital of Kerala. It was the third busiest airport in the country in terms of international passenger movement and seventh largest in terms of total passenger volume for the year 2022. Cochin Airport still comes in top 10 busiest airports in India. It has witnessed more than 24 different airlines operating domestically and from 31 plus countries and inflow of more than 100 million commuters till date. This Airport caters to 61.8% of the total air passenger movement in Kerala.

The airport operates three passenger terminals, including an exclusive Business Jet Terminal. It also achieved unique feat of self-sustaining energy requirement by setting up a solar plant and meeting up its daily operational activities. For this entrepreneurial vision, the airport won the coveted ‘Champion of the Earth’ award in 2018, the highest environmental honour instituted by the United Nations.

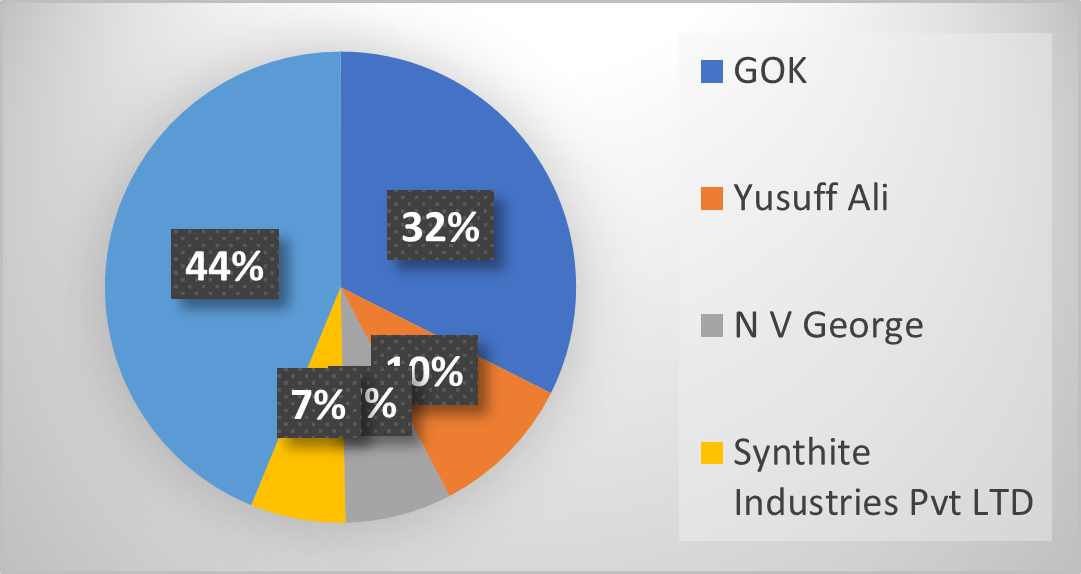

CIAL has performed financially well and has been paying divided since 2003-04. It’s one of the few airports that have been profitable at operational level even during the pandemic. The government of Kerala is CIAL’s single largest investor with ~32% of the shareholding. Hon. Chief Minister of Kerala Mr. Pinarayi Vijayan sits as the current chairman of the company.

The Total Revenue for the year ended FY23 was INR 770.9 crores. It earned an operating profit of INR 521.49 crores during FY23 as against INR 217 crores during FY22 with an increase of 140%. After charging interest on borrowed funds, it made a cash profit of INR 482.65 crores during the fiscal 2023. The profit before and after tax were INR 357.30 crores and INR 267.17 crores respectively.

It minted aero & non-aero revenue which was around INR 477.88 crore & INR 222.99 crore respectively in FY23. Aero Revenue consist of landing fee, screening charges, royalties, cargo operation whereas non aero revenue majorly draws from rental & other utility services.

CIAL is targeting to diversify their business model & set to become a 3000-crore company at the end 2023 - with 20% contribution coming from Aero revenue, 30% non-Aero revenue and 50% Non-Aviation revenue.

| INR-Crores | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|---|

| Op. Revenue | 686.1 | 748.2 | 781.3 | 267.6 | 502.3 | 939.63 |

| Total Revenue | 701.1 | 807.4 | 810.1 | 296.7 | 524.2 | 954.83 |

| Op. Expenses | 285.6 | 372.8 | 335.2 | 222.5 | 275.3 | 351.4 |

| EBITDA | 415.5 | 434.5 | 474.9 | 74.2 | 248.9 | 566.77 |

| Depreciation & Amortization | 112.1 | 116.8 | 135.6 | 141.1 | 145.4 | 141.67 |

| EBIT | 303.4 | 317.7 | 339.3 | -66.9 | 103.5 | 136.47 |

| Finance Cost | 42.6 | 46.7 | 54.3 | 56.1 | 54.9 | 44.83 |

| PBT | 260.8 | 271.0 | 285.0 | -123.0 | 48.6 | 391.68 |

| PAT | 172.3 | 188.5 | 237.7 | -92.9 | 35.0 | 292.74 |

| EPS | 4.5 | 4.9 | 6.2 | -2.4 | 0.9 | 7.59 |

| Key Margins & Ratios | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|---|

| EBITDA Margin | 59.3% | 53.8% | 58.6% | 25.0% | 47.5% | 59.40% |

| PBT Margin | 43.3% | 39.4% | 41.9% | -22.6% | 19.7% | 46.11% |

| Tax % | 32.0% | 30.4% | 13.5% | 24.5% | 28.0% | 25.23% |

| PAT Margin | 24.6% | 23.3% | 29.3% | -31.3% | 6.7% | 34.48% |

| RoA | 7.1% | 7.1% | 8.5% | -3.5% | 1.4% | 8.8% |

| RoE | 13.2% | 13.7% | 16.3% | -6.6% | 2.6% | 19% |

| Current Ratio | 1.03 | 1.10 | 1.11 | 0.88 | 0.82 | 2.98 |

| P/E at Price of INR 163 | 36.19 | 33.08 | 26.24 | -67.14 | 178.22 | 21.47 |

| Debt/Equity Ratio | 0.34 | 0.40 | 0.37 | 0.50 | 0.43 | 0.38 |

| Financial Year | Turnover (INR Crore) | Profit before tax (INR Crore) | Profit after tax (INR Crore) | % of dividend |

|---|---|---|---|---|

| 2003-04 | 85.26 | 36.05 | 21.12 | 8 |

| 2004-05 | 100.26 | 48.03 | 28.79 | 10 |

| 2005-06 | 110.67 | 38.82 | 31.78 | 10 |

| 2006-07 | 111.87 | 44.4 | 37.19 | 8 |

| 2007-08 | 138.2 | 51.23 | 36.81 | 8 |

| 2008-09 | 173.06 | 68.93 | 59.34 | 10 |

| 2009-10 | 211.64 | 96.61 | 77.52 | 12 |

| 2010-11 | 245.59 | 116.21 | 90.1 | 15 |

| 2011-12 | 275.94 | 134.44 | 102.08 | 16 |

| 2012-13 | 306.5 | 142.23 | 111.42 | 17 |

| 2013-14 | 361.39 | 157.47 | 124.38 | 18 |

| 2014-15 | 413.96 | 179.28 | 144.56 | 21 |

| 2015-16 | 524.54 | 234.42 | 175.22 | 25 |

| 2016-17 | 487.28 | 256.32 | 179.44 | 25 |

| 2017-18 | 553.41 | 234.42 | 158.42 | 25 |

| 2018-19 | 650.34 | 246.83 | 170.65 | 27 |

| 2019-20 | 655.05 | 247.83 | 215.13 | 27 |

| 2020-21 | 252.71 | -115.14 | -87.21 | 0 |

| 2021-22 | 418.69 | 37.68 | 26.12 | 0 |

| 2022-23 | 767.68 | 354.09 | 264.76 | 35 |

| GOK | 32.42 |

| Yusuff Ali | 11.76 |

| N V George | 7 |

| Synthite Industries Pvt LTD | 3 |

| Others | 45.82 |

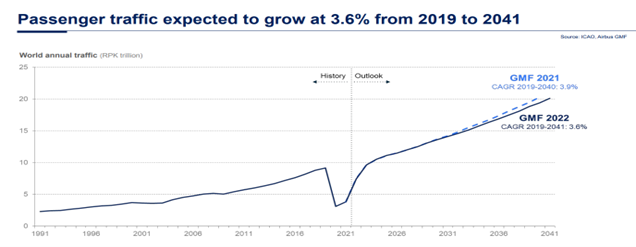

As the world is getting connected, it is seeing upward trend in a transportation sector, specifically airline industry, which is enjoying phenomenal times. During the peak of pandemic, the aviation market went through a turbulent time after evaporating billions of dollars due to lockdown. The airline industry includes passenger transportation & cargo airlines which is required to reach at destination & to ease out this process airport operator are always on their toe. The global airport operations market is projected to reach USD 13.8 billion by 2031, growing at a CAGR of 6.3% from 2022 to 2031.

As per the recent report published by Airbus, below mentioned points were highlighted: -

Air cargo’s contribution to employment and economic output is substantial. Air transport carries around 35% of world trade by value and less than 1% by volume.

Airport operation is a niche area that requires to exhibit an expertise on various forefront from operations to service. Aviation connections support commerce and business, governments and education while air cargo provides essential services, carrying 35% of world trade by value, including assistance for global health systems. Due to increase in frequency and affordability because of high demand & easily accessible low-cost fleet carrier which helped commuters to connect & travel more frequently along with shooting up the figures of air cargo trade.

Currently, Airport Authority India (AAI) leased out eight of its airports under Public Private Partnership (PPP) namely Delhi, Mumbai, Lucknow, Ahmedabad, Mangalore, Jaipur, Guwahati, Cochin & looking forward to lease out twenty-five more as per the report published by Ministry of Civil Aviation over the period of three years between 2022 to 2025.

The Airports Authority of India (AAI) and other airport developers have taken up the development of new and existing airports with a projected capital expenditure of approximately INR 98,000 crore in the next five years. The Union Budget 2023-24 allocated an amount of INR 1,244.07 crore for Regional Connectivity Scheme (UDAN). The National Civil Aviation Policy in another initiative aimed at promoting growth in the aviation sector by providing incentives for the development of airport infrastructure, reducing taxes, and simplifying regulations. With up to 100 percent FDI permitted in Greenfield and existing airport projects and for MRO (maintenance and repair organisations) under the automatic route, India is attracting investors to the sector.

In a historic event, Tata Group-owned Air India has announced its commitment to order 470 aircraft to boost its domestic and international operations. The commitment includes single-aisle aircraft as well as wide-body jets that will mark a new era for Indian aviation market. Deliveries are set to commence by late-2023.

| Year | Aircraft (Dom & Int) | Passengers (In Lakhs) | Cargo (in MT) |

|---|---|---|---|

| 2003-04 | 16,590 | 13.33 | 13,325 |

| 2004-05 | 18,611 | 15.96 | 18,274 |

| 2005-06 | 20,975 | 18.86 | 21,625 |

| 2006-07 | 30,673 | 25.61 | 21,933 |

| 2007-08 | 39,168 | 33.38 | 27,070 |

| 2008-09 | 41,172 | 33.63 | 30,761 |

| 2009-10 | 41,544 | 39.46 | 41,561 |

| 2010-11 | 41,081 | 43.45 | 41,093 |

| 2011-12 | 41,141 | 47.23 | 42,844 |

| 2012-13 | 41,538 | 49 | 46,530 |

| 2013-14 | 47,216 | 53.86 | 54,440 |

| 2014-15 | 52,784 | 64.28 | 64,940 |

| 2015-16 | 57,762 | 77.71 | 79,086 |

| 2016-17 | 62,827 | 89.41 | 84,409 |

| 2017-18 | 69,661 | 100.12 | 90,446 |

| 2018-19 | 71,871 | 100.2 | 76,366.10 |

| 2019-20 | 67,750 | 97.11 | 73,589 |

| 2020-21 | 26,986 | 24.70 | 45,838 |

| 2021-22 | 43,195 | 47.58 | 59,582 |

| 2022-23 | 61,231 | 89.28 | 72,818.20 |

Recently, Cochin International Airport Ltd (CIAL) updated its summer schedule which will be effective from 26th March till 28th October 2023. A total of 1484 weekly operations are the highlight of this schedule against 1202 operations for the ongoing winter schedule.

CIAL’s summer schedule will see 31 airlines among which 23 are international carriers operating 332 weekly departures to international destinations.

Note- Go Airlines (India) Limited has filed for insolvency proceedings. It currently serves 12 million passengers per annum. CIAL & all other airports can witness initial dip but eventually substitute carrier absorbing those commuters by different airlines.

Third largest air passenger market: With the demand reaching new horizon & scheme like UDAN (Central Govt) added new routes in domestic market which simultaneously created a buzz in airline industry to add more fleets in their arsenal that will subsequently increase the growth. Currently, India has crossed the mark of entertaining more than 4.56 lakhs passenger on a daily basis & it is heading to 140 million passengers in FY24 alone at a CAGR of 14.5%.

Focus on becoming a Strategic aviation Hub of South: The future plan of CIAL is to position itself as a pioneer in Aviation Infrastructure and generate sustainable & profitable revenue streams by establishing a strategic hub in Southern India. Due to its strategic built-up location in the southern part of India providing international connectivity to the Middle East region focuses on development of aviation infrastructure including aircraft maintenance centre & training academy and airlines focus on land development to enhance city side infrastructure.

Development of the massive land owned by the airport: CIAL has approximately 100 acres of unused land with it. It has drafted a Land Utilization Plan (LUP), which aims to transform this unused land into business Hub & also integrate a special rail corridor to bring in more cargo & commuters. It is also prompting ahead with non-Aviation income by building aero city, entertainment facility & hotel chains to cater tourist & investors.

Further measures to increase Non-Aero revenue: Recently, IHCL invested INR 100 crores in Cochin Airport’s to make a 5-star hotel. At the same time a transit hotel at the departure area is underway & is expected to be completed by 2024, which will attract tourists. Commercial rentals, On-premise advertising and Car parking charges will further raise revenue to support extensive upgrade projects coming up in airport vicinity.

Growth of from Business Jet segment: The business Jet segment in India underwent a 25% growth in 2021. The current fleet size of Private Jets is estimated to be at ~550 and it’s expected to grow by approx. 10% every year. This is a big positive for Cochin as only 4 airports in the country have a dedicated Business Jet Terminal, Terminal- 2, where the arrival area is now converted into an exquisite business jet terminal. Also, CIAL has also introduced aquaculture practices at CIAL Golf Club water bodies. As part of the business diversification programs which will generate their aviation & non-aviation revenue.

Growth in Cargo/Freight Segment: Cochin is the commercial capital of the state of Kerala. Along with being one of the biggest ports in Southern India, it has major refineries as well as industries. It also has well-developed Railways & Roadways connectivity making it an ideal place for a commercial hub. These factors will further help in the growth of air-cargo.

Proximity to other big International Airports:The biggest needle in the route of CIAL is to deal with other airports located in Thiruvananthapuram, Kozhikode, Kannur & one more which was given nod recently will be coming up in Sabarimala. These numbers of airports (5) built up in proximity for a small state by area like Kerala bring out different sets of challenges.

Impact of any recession or pandemic like situation: A big setback to CIAL came because of the Covid-19 pandemic. It completely changed the dynamics of the business and depleted the reserve & increased the expenditure giving rise to the revenue risk & operational risk. If the world undergoes a big recession or in case, there is another pandemic like event, it can have a massive negative impact on air-travel and thus the airport.

Major International Traffic from the Gulf:A large share of revenues for a big airport is from international traffic, and same is also true for CIAL. However, the Gulf-region provides a major part of this international traffic. If CIAL fails to attract other western countries, not only will it be setback for their dream of being an international hub, this regional dependency on a single area will also become a risk.

Recent speculation & Grounding of Go First:Grounding of Go-First Air has left India with only 4 national level Airlines. There are also speculations of financial instability in Spice Jet. Any permanent grounding of these two airlines, will leave India with a duopoly-like situation with only Indigo & Tata-owned airlines controlling more than 85% of domestic-passenger aviation market and may pose a risk of cartelisation.

Stabilising conditions in Sri Lanka:The financial crisis in Sri Lanka had provided a new window of opportunity for South Indian airports, especially Cargo and Business travels. However, with Sri Lanka getting stabilised, CIAL will start facing renewed competition from airports in Colombo and Mattala.

Cochin International Airport Limited also has following for subsidiary companies:

CIAL has an associate company, Kerala Waterways and Infrastructures Limited (KWIL). It also owns an 18-hole golf club (CIAL Golf Club), a trade facility centre (CIAL Trade and Convention Centre) and two hangars.

Shri. Pinarayi Viyayan (CM of Kerala)- Chairman

Shri. S. Suhas (IAS) - Managing Director

Shri. Saji Daniel- Chief Financial Officer

Shri. Saji. K. George- Executive Director & Company Secretary

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111