Motilal Oswal Home Finance Limited (MOHFL) is primarily engaged in the business of providing loans for purchase or construction of residential houses. It also provides consumer loans (top-up loans) and loan against properties. MOHFL major focus has been to provide home loans to individuals and families for purchase, construction and extension of house.

MOHFL also provides loans for repair and renovation of houses and home loans to families in the new to credit, self-employed, cash salaried category where formal income proofs, Credit Bureaus reports are not easily available, and the repayment capacity of such families are appraised based on their cash flows and internal score cards. MOHFL had signed a MOU with National Housing Bank (NHB) which is the Central Nodal Agency under the Pradhan Mantri Awas Yojana (PMAY) for the Credit Linked Subsidy Scheme (CLSS).

In FY23 MOHL reported the highest ever PAT at INR 136 crore with a growth of 44% YoY, also strong growth on ROA & ROE at 3.5% & 10% respectively. US International Development Finance Corporation (DFC) world’s largest development finance institution has committed $50 Mil long term loan to the firm via ECB (External Commercial Borrowing) route to be availed in 5 tranches of $10 Mil each. Total loan disbursements in FY 23 grew by 57% YoY to INR 1,007 crore. Cost of borrowing came down in FY23 & stood at 7.96%.

MOHFL earned the gross income worth of INR 531.93 Crore in FY23 as against INR 526.2 crore in FY22. The total expenditure during the same time is INR 356.39 Crore as against INR 407.89 crore last year. The Net Profit after tax is INR 136 crore against INR 94.89 crore in FY22. Rating given by ICRA has been upgraded from long term rating from AA- (Stable) to AA (Stable).

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 |

|---|---|---|---|---|---|---|---|

| Gross Sales | 526.80 | 521.70 | 539.19 | 573.00 | 641.47 | 646.34 | 492.92 |

| PBT | 175.54 | 118.31 | 90.45 | 60.92 | -211.56 | 48.57 | 125.67 |

| PAT | 136.36 | 94.89 | 40.23 | 39.08 | -136.88 | 31.49 | 82.09 |

| Cash Flow from Operations | -239.18 | 175.43 | 319.70 | -15.55 | -155.86 | -630.60 | -1865.57 |

| Cash Flow from Investing | -4.66 | -19.45 | -18.53 | 43.77 | -49.44 | 286.53 | -41.88 |

| Cash Flow from Finance | 287.85 | -244.53 | -95.00 | 5.24 | 200.41 | 267.01 | 2049.94 |

| Debt to Equity | 2.2 | 2.60 | 3.14 | 3.40 | 4.35 | 4.91 | 6.00 |

| Current Ratio | 1.38 | 1.89 | 2.42 | 49.81 | 21.70 | 0.30 | 1.11 |

| EPS | 0.23 | 0.16 | 0.07 | 0.06 | -0.23 | 0.06 | 0.17 |

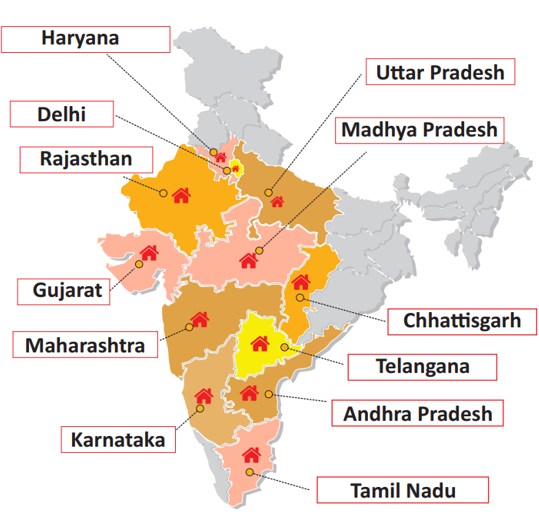

It has presence in 109 locations across 12 states/UT.

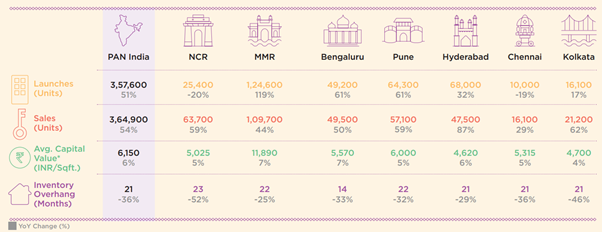

2023 is a phenomenal year for the real estate sector, particularly the residential segment. There was a robust housing demand, primarily from the end-users, across the top 7 cities as well as the tier 2 and tier 3 cities of India. As per ICRA’s report, the total outstanding housing finance credit for NBFC-HFC as on Dec 2022 stood at INR 13.2 lakh crores. Increasing level of economic activity coupled with healthy demand in the industry are expected to result in a steady growth of disbursements going forward. Within HFCs, the affordable housing segment is expected to grow at a faster pace than the overall industry supported by robust demand and liquidity support. ICRA’s estimated, the HFC portfolio is expected to grow by 8-10% in FY2022 and 9-11% in FY2023. The industry had an outstanding standard restructured book of 1.4% of the AUM as on Sept 2022 as compared to 1.7% as on March 2022.

Motilal Oswal Financial Services Limited holds majority of stake i.e. 80.24% followed by Motilal Oswal Finvest Limited i.e. 9.96%

Motilal Oswal – Chairman & Non-Executive Director

Shalibhadra Shah – Chief Financial Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111