Mobikwik is the fintech firm which became the largest digital credit player and second largest mobile wallet in India. They expanded their suite of financial products for consumers and merchants from payments to digital credit and investments. They commenced operations as a mobile wallet to make digital payments convenient for consumers but soon started progressing to a on neo banking platform.

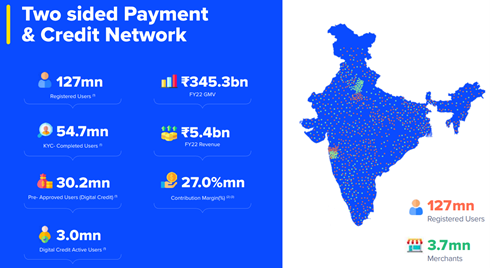

Digitally paying users have been rapidly growing in India in the last decade, but the credit card penetration in the country is still very abysmal. MobiKwik today has 127 million registered users who can make payments for all their daily life needs, including utility bills, eCommerce shopping, food delivery, and shopping at large retail chains, mom & pop (kirana) stores, etc. across a 3.7 million strong merchant network. They are focused on unserved citizens their first experience of credit.

It has 3.7 Mil strong pan India merchant network under various categories. For instance under E-Commerce (Swiggy, Zomato, Domino’s, Irctc, Meesho, Myntra , 1 mg, Pharmeasy etc); Physical stores (Croma, Apollo Hospital, Crossword, Pantaloons etc); Billers (Vodafone, DishTV, Jio, Tata Play, Airtel Bharat Billpay etc). They are a technology-first company leveraging big data analytics and deep data science (including machine learning) to continuously delight users and merchants on their platform.

For instance, under E-Commerce section, list of merchants using Mobikwik’s platform: - Swiggy, Zomato, Domino’s, Irctc, Meesho, Myntra, 1 mg, Pharmeasy etc.

Under Physical stores following merchants are beneficiary of it: -Croma, Apollo Hospital, Crossword, Pantaloons etc.

List of merchants under Billers sections: - Vodafone, DishTV, Jio, Tata Play, Airtel Bharat Billpay etc.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|

| Income from Operation | 539.46 | 526.57 | 288.57 | 355.68 | 148.48 |

| PBT | -80.6 | -128.42 | -110.26 | -98.05 | -151.2 |

| PAT | -83.8 | -128.16 | -111.3 | -99.92 | -147.97 |

| Cash Flow from Operations | 27 | -320.59 | -34.51 | -18.25 | -138.32 |

| Cash Flow from Investing | 0.67 | -84.77 | 10.49 | 13.16 | 73.47 |

| Cash Flow from Finance | 17.9 | 329.42 | 72.57 | -23.2 | 54.42 |

| Debt to Equity | 1.35 | 0.87 | -1.12 | -1.34 | -13.79 |

| Current Ratio | 1.02 | 1.05 | 0.76 | 0.86 | 0.97 |

| EPS | -14.66 | -22.38 | -53.57 | -50.38 | -62.63 |

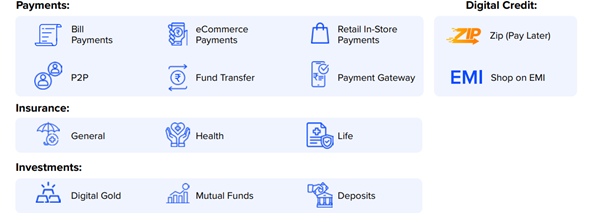

Instantly doing bill payments with MobiKwik is fascinating experience for their users which saves time, money & energy. It offers discounts, cashback for the transactions done & encourage more users to be part of it.

MobiKwik not only enables their users to pay & save on online transactions, but also takes care of wealth management & credit facilities for their users. It offers various products for instance one can opt for mutual funds, digital gold, instant loans, money transfers, pay later & more services. With MobiKwik, users can invest in the right Mutual Fund starting at mere sum of just ₹100 giving them the liberty to start small and build their investment portfolio with several investment options. Also, with new features like MobiKwik’s spend now, pay later service, one can get a credit up to INR 60,000 at zero cost to shop, pay bills and much more, making it easier for the users to manage cash crunch. MobiKwik launched ‘MobiKwik RuPay Card’ in association with NPCI and Axis Bank.

India’s online transacting users has rapidly grown at a CAGR of approximately 15% from 180 million in Fiscal 2018 to over 250 million in Fiscal 2021. However, India had only 30-35 million unique credit card users resulting in a low credit card penetration of 3.5%, as of March 31, 2021. In addition, India’s online BNPL (Buy Now Pay Later) market has rapidly grown to reach US$ 3-3.5 billion in disbursals in Fiscal 2021 and is expected to grow to US$ 45-50 billion by Fiscal 2026 driven by user growth.

Bipin Preet Singh – Managing Director & Chief Executive Officer

Chandan Joshi – Whole Time Director

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111