It is a recognized national level stock exchange (regulated by SEBI) in India. MSE offers an electronic platform for trading in Currency Derivatives, Interest Rate Derivatives and Equity Cash & Equity Derivatives segments. The Exchange employs advanced trading technology and IT infrastructure with significant scalable capacity and proven capability of handling high volume trades.

The current ownership of the Exchange is well diversified between corporates, banks and individuals. At present in Currency Derivatives Segment (CDS), Currency Futures and Options contracts are available for trading in USD/INR, GBP/INR, EUR/INR and JPY/INR contracts along with cross currency pairs of EUR/USD, USD/JPY, GBP/USD. Currency Derivatives Segment also provides trading of Interest Rate futures where futures contracts are available on 6 GOI Bonds with maturity buckets of 6 years, 10 years and 13 years. In the Equity cash segment, 1493 companies are available for trading. In Equity Derivatives, Stock Futures and Stock Options are available for trading in the Exchange on 156 stocks. Also Index Futures and Index Options are available for trading on MSE Index SX40. 48 ETFs are available for trading and 42 Sovereign Gold Bonds issued by RBI are also available for trading on the Exchange.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

| Revenue from Operation | 9.22 | 10.06 | 10.63 | 10.29 | 8.04 | 8.49 |

| PBT | -19.93 | -31.26 | -30.67 | -45.01 | -38.45 | -54.76 |

| PAT | -18.66 | -31.67 | -31.08 | -45.77 | -40.59 | -54.75 |

| Cash Flow from Operations | -172.1 | -44.59 | -37.93 | -41.52 | -10.21 | -75.43 |

| Cash Flow from Investing | 167.76 | 60.5 | 31.23 | 89.56 | -18.11 | -200.33 |

| Cash Flow from Finance | -3.28 | -2.98 | -4.38 | -36.59 | 28.35 | 272.66 |

| Debt Equity Ratio | 0.53 | 0.68 | 0.64 | 0.56 | 0.54 | 0.34 |

| Current Ratio | 7.08 | 6.28 | 6.31 | 3.59 | 4.78 | 3.01 |

| Debtor Turnover Ratio | 4.62 | 3.46 | 6.64 | 8.82 | 6.02 | 17.93 |

| EPS | -0.04 | -0.06 | -0.05 | -0.1 | -0.1 | -0.12 |

On a standalone basis - Total Revenue increased from INR 14.15 crore in FY22 to INR 29.84 crore in FY23. During the same time, Operating Revenue increased from INR 5.50 crores to INR 7.55 crores.

Revenue mostly comprises of transaction fees, membership admission fees, processing fees, annual listing fees, revenue from shared service, data feed charges etc.

MSE’s offers a variety of products and services across multiple asset classes in India which enables it to be responsive to the market demands. Its tech-based platform and robust network is a pioneer in to ensures reliability and performance of its systems. MSE’s products and services foster digital transformation on technology, cyber security, innovation and intelligence solutions. These are products offered by MSE across various segments to Proprietary, Retail Participants, Institutional Participants (Domestic and Foreign).

Index SX40 is flagship, a free float-based Index of 40 large cap-liquid stocks represents diversified sectors of the economy. SX40 measures the economic performance with better representation of various industries. The Index is devised to offer cost effective support for investment and structured products such Index Futures and Index Options, Index portfolio, Exchange Traded Funds, Index Funds etc. SXBANK is designed to measure the performance of stocks of banking sector – the sector that funds various economic activities of the nation. The Index will have 10 stocks from the banking sector. Weights of individual stocks in the index have been capped at 15% to reduce concentration and thereby provide a cost-effective support for investment/portfolio management.

Upcoming Products and Services though MSE continues its focus on increasing its market share in existing segments and products, over a long term MSE plans to introduce and implement a wide range of additional products including SME platform, Book Building System, Offer to Buy and Mutual Fund System

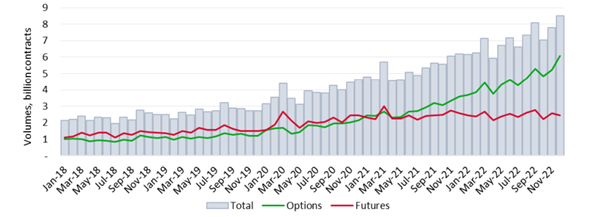

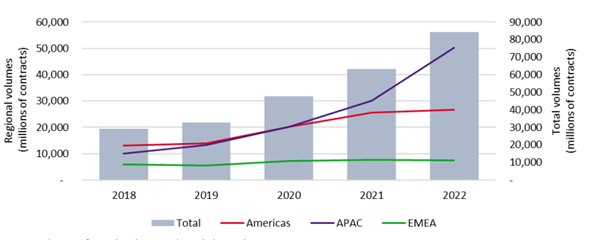

According to the World Federation of Exchange, trading volume went up by 34.4% for APAC region. Which is significant rise & increased the total volume by 84.76 billion derivative contracts traded. Out of it 56.17 billion were for option and 29.59 billion for future. However, APAC region dominated the volume figures where 50.32 billion contracts were traded followed by America’s 26.84 billion & rest added by EMEA region 7.60 billion. India also secured the top place and known for the largest derivative market by volume & has been witnessing enormous growth since last decade.

Majority of stake is under control of Individuals (55%) followed by Corporate Bodies (18.05%), Financial institutions (14.94%), NRI (7.49%), HUF (4.40%).

Metropolitan Clearing Corporation of India Limited & MSE Fintech Limited

Mr. S.V.D. Nageswara Rao- Chairman and Public Interest Director

Ms. Latika S Kundu- Managing Director & CEO

Mr. Saket Bhansali- Chief Financial Officer

Mr. P K Ramesh- Chief Regulatory Officer & Compliance Officer

Mr. Utkarsh Sharma- Head Business Development

Mr. Manish Gupta- Chief Technology Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111