Merino is a versatile manufacturer and marketer of Interiors Solutions with a wide array of products for homes, offices, commercial and public areas. Decades of strong market presence have created a high brand recall among various customer segments. Tapping the synergy of their product line and services, they have achieved a competitive edge through technology innovation and by delivering a greater customer satisfaction.

Laminate, Panel Products, Potato Flakes, Agricultural byproducts.

It operates mainly in the following three segments, namely, manufacturing of Laminates, Potato Flakes and Panel Products & Furniture. In Interior Solutions, plywood is successfully established the reputation for their good quality and service.

Merino recorded a total revenue of INR 2,205.42 crore in fiscal 2023 as compared to INR 1,792.13 crore in the previous year with a 23.06% increase. The profit before tax was INR 174.1 crore as compared to INR 175.08 crore in the previous year. Merino’s net profit after taxes stood at INR 117.65 crore as against INR 128.36 crore last year. Export revenue has grown by 20% from FY22 to be INR 640.72 crore.

Almost ~80% of contribution came from single product line Laminate followed by Panel Product.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

|---|---|---|---|---|---|---|

| Revenue | 2,205.42 | 1,792.13 | 1,338.85 | 1,492.22 | 989.99 | 823.99 |

| EBITDA | 269.63 | 251.17 | 251.77 | 238.95 | 160.55 | 136.07 |

| PBT | 174.1 | 175.08 | 176.92 | 159.16 | 116.59 | 94.84 |

| PAT | 117.65 | 128.36 | 131.86 | 129.43 | 85.89 | 67.51 |

| Cash Flow from Operations | 184.4 | 74.54 | 330.71 | 169.87 | 97.84 | 56.51 |

| Cash Flow from Investing | -458.72 | -219 | -267.97 | -131.9 | -80.65 | -45.94 |

| Cash Flow from Finance | 246.66 | 103.92 | -71.02 | -21.88 | -20.92 | -12.81 |

| Debt to Equity | 0.5 | 0.28 | 0.17 | 0.29 | 0.35 | 0.45 |

| EBITDA Margin | 12.23 | 14.02 | 18.81 | 16.01 | 16.22 | 16.51 |

| Current Ratio | 1.38 | 1.52 | 1.61 | 1.65 | 1.38 | 1.41 |

| EPS | 105.24 | 118.28 | 117.25 | 115.78 | 82.83 | 65.1 |

In Information Technology Services, Merino Services Limited is a Business Consulting and IT Services organization providing value-added services as a Partner-in-Progress with our esteemed customers and business associates. They specialize in design/implementation of various business solutions for customers.

In the Agro Business, the Merino Group began in the cold storage business and subsequently diversified into farming, biotechnology and food processing. The integrated approach enables them to offer various products - from raw material to finished product. The integration in both directions - forward and backward - has shaped their brand identity in the FMCG market where they have launched potato flakes and ready to eat snack mixes under the brand name 'Vegit'.

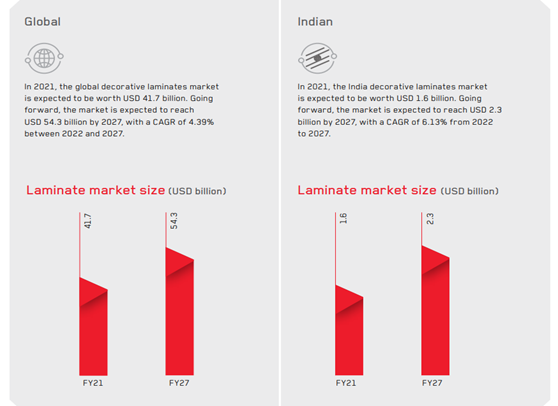

The rapid urbanization of Indian cities in the last three decades to accommodate the rising population which recently overtook China in numbers & expected to be 1.52 billion by 2036. Also with real estate development projects boosted by ongoing demand and regulatory backing with government scheme like Pradhan Mantri Awas Yojana (PMAY) for first time buyer will help to flourish this vertical along with positive outlook towards the industry.

Merino specialty in ongoing release of their new products which are aligned to international trends and market demand. Over the years, their innovations have been continuously well received by the industry critics. Their objectives are to maximize the product value, affordability and deal fairly to build a long relationship. Apart from organic business, the firm is looking to expand their horizon in inorganic product line which includes FMCG & agricultural byproducts. This motivated move is to dominate the market & establish Merino’s brand name in domestic as well as international markets. With the simultaneous growth in foreign markets and adding more countries at their disposal will help them to improve their margins and revenue.

Mr. Champalal Lohia- 11.42%

Mr. Rup Chad Lohia - 11%

Mrs. Tara Devi Lohia- 10.41%

Mr. Prakash Lohia- 10.63%

Mr. Madhusudan Lohia– 8.92%

Mrs. Praveena Lohia- 8.77%

Ms. Ruchira Lohia- 6.55%

Mrs. Sita Devi Lohia- 2.30%

Shri Rup Chand Lohia – Executive Chairman

Shri Prakash Lohia – Managing Director

Mr. Sachin Selot– – Chief Financial Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111