Hexaware is a global technology and business process services company. It provides valuable input to following key sectors in industry: - Banking and Financial Services, Healthcare and Insurance, Travel and Transportation, Manufacturing and Consumer, Hi-Tech & Professional Services & also offers following expertise in the field of Digital Product Engineering (DPE), Cloud Transformation, Digital Core Transformation (DCT), Digital IT Operation (ITO), Enterprise and Next Generation Services (E&NGS), Business Process Services (BPS) respectively.

Hexaware understands the importance of technology and its significant role and contribution in the persistent growth and development of the firm which is why it keeps on heavily investing on recent time technologies such as cloud services, artificial intelligence, Internet of Things, Robotic Process Automation, 5G Technology.

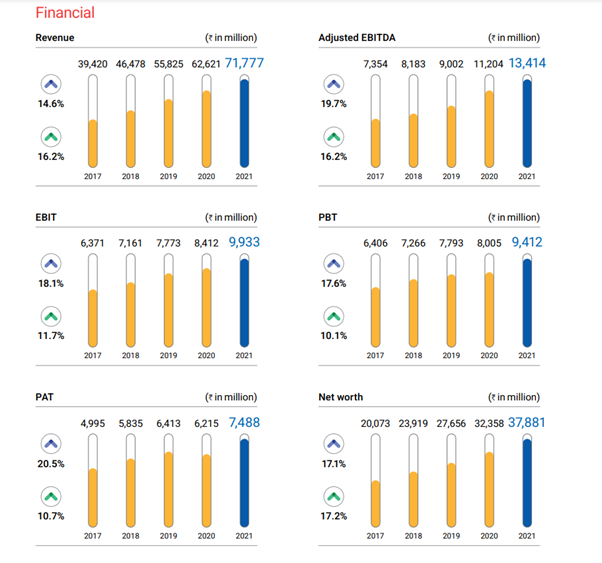

Hexaware continues to maintain a strong balance sheet with healthy cash and cash equivalents, attractive reinvestments, and zero debt that allow us to flourish.

Its revenue grew by 14.6%, from INR 62,621 million in 2020 to INR 71,777 million in 2021. Maximum amount of revenue chipped in from following sectors - financial services, healthcare & insurance followed by manufacturing and consumers.

Other income increased by INR 11.52 million to INR 90.24 million in FY 2021 from INR 78.73 million in FY 2020. The increase is mainly attributed to increase in gain on sale of investment by INR 30.58 million and other miscellaneous income by INR 11.60 million partially being offset by decrease in interest income by INR 30.66 million

Their 5-year revenue CAGR in rupee term stood at 16.2%, which is much faster than the industry growth. This reflects their commitment towards continuous progress. It comfortably surpassed US$1B revenue run rate benchmark in H2 2021.

| DESCRIPTION | Dec-21 | Dec-20 | Dec-19 | Dec-18 | Dec-17 | Dec-16 |

|---|---|---|---|---|---|---|

| Gross Sales | 3216.65 | 2427.79 | 2140.91 | 1794.03 | 1524.11 | 1393.04 |

| PBT | 726.13 | 631.24 | 609.12 | 551.78 | 496.72 | 445.94 |

| PAT | 587.29 | 538.18 | 507.53 | 452.96 | 410.96 | 351.43 |

| Cash Flow from Operations | 994.62 | 709.58 | 365.45 | 339.30 | 250.45 | 534.70 |

| Cash Flow from Investing | -395.66 | 2.22 | -125.08 | -44.62 | -89.94 | -188.68 |

| Cash Flow from Financing | -324.65 | -250.48 | -305.31 | -250.21 | -279.52 | -249.39 |

| Current Ratio | 3.54 | 3.82 | 4.01 | 3.94 | 3.82 | 2.27 |

| EPS | 19.47 | 17.92 | 17.01 | 15.23 | 13.85 | 11.64 |

Nominal Value per share is INR 2 per share.

According to Gartner Inc, worldwide IT spending is projected to total $4.5 trillion in 2023, an increase of 2.4% from 2022. This is down from the previous quarter’s forecast of 5.1% growth. While inflation continues to erode consumer purchasing power and drive device spending down, overall enterprise IT spending is expected to remain strong.

| 2022 Spending | 2022 Growth (%) | 2023 Spending | 2023 Growth (%) |

|---|---|---|---|

| Data Center Systems | 2,12,376 | 12 | 2,13,853 |

| Software | 7,83,462 | 7.1 | 8,56,029 |

| Devices | 7,22,181 | -10.6 | 6,85,633 |

| IT Services | 12,44,746 | 3 | 13,12,588 |

| Communications Services | 14,22,506 | -2.4 | 14,23,367 |

| Overall IT | 43,85,270 | -0.2 | 44,91,471 |

Source: Gartner (January 2023)

Shares of the company were delisted from the stock exchanges on November 9, 2020 in accordance with the delisting regulations.

Michael W. Bender – Non- Executive Chairman

R Srikrishna – CEO & Executive Director

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111