Hero FinCorp, one of India’s largest privately owned Non-banking Finance Companies (NBFC). For a bank, success is measured by the way they create and deliver delightful customer experiences. That's where Hero FinCorp comes in. They combine their process and industry knowledge with cutting-edge technologies to drive customer delight and loyalty. Incorporated in 1991 as Hero Honda FinLease Limited, the restructuring of their parent company Hero MotoCorp Limited, led to their present form as Hero FinCorp Limited.

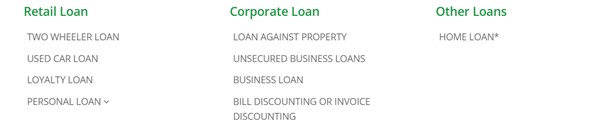

Hero FinCorp offers a wide range of products and services across Retail, SME, and Corporate Lending segments. Overall, it serves over 7 million customers through its 4,000 plus touchpoints, spread across more than 2,000 locations. Hero FinCorp also has a dedicated home finance arm called Hero Housing Finance which is a 100% subsidiary with an Asset Book of over INR 2,500 Cr. and presence across major domestic markets.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

|---|---|---|---|---|---|---|

| Total Income | 6447.55 | 4797.66 | 4333.52 | 3855.18 | 2518.47 | 1694.51 |

| PBT | 735.22 | -254.03 | 71.07 | 448.79 | 391.04 | 212.36 |

| PAT | 479.95 | -191.90 | 51.62 | 278.03 | 245.75 | 142.93 |

| Cash Flow from Operations | -7016.41 | -5411.55 | -1840.00 | -4100.37 | -5862.5 | -3121.34 |

| Cash Flow from Investing | -457.34 | 830.41 | -1753.77 | 767.78 | -726.13 | -31.16 |

| Cash Flow from Finance | 7349.27 | 4348.76 | 2356.7 | 5569.85 | 6694.62 | 3150.43 |

| EPS | 37.67 | -15.07 | 4.05 | 22.88 | 21.53 | 14.52 |

The credit rating given by various rating agencies:

Indian economy will continue its growth trajectory for FY-23 with IMF & World Bank projecting a growth of 7-7.5% p.a. While being on a growth path, new challenges arise because of surge in crude oil prices & commodity prices, soaring inflation & rising Geo-Political tensions. However, the momentum of economic activity & opportunities of growth has remained intact despite the challenges. The economic growth will be driven by expected normal monsoon, increase in public & private investment along with continuous monetary and fiscal policy inspection.

The firm is banking on strong parentage, liquidity and clear business strategy that is well equipped to grab the opportunities for all line of businesses. Economic recovery and increased consumption will lead to rise in credit demand from across the spectrum of customers and will drive growth. HFCL is responsive to the changing landscape in the financial services industry. It is confidently better placed to overcome the new challenges and sustain its performance in a challenging environment.

HFCL diversified product portfolio helps to initiate different strategies for instance in the two-wheeler segment, the firm has focused on customers who are left out of the banking network for reasons like limited documentation, limited credit history and hence are perceived as a high-risk category by the banking channels. It also provides a bouquet of other financial products including used car financing, loyalty personal loan, inventory funding, loan against property, loans to SMEs and emerging corporates.

Retail Business: - The Two-Wheeler business is present at 900 dealerships at the end of FY23. The services are now available at over 4,100+ touch points across 2,000 cities, towns & villages. The Retail team has built the capacity to disburse a loan every 10 seconds and have serviced over 7 million happy customers. A total of over 10 Lakh of Two-wheeler loans were disbursed in the last financial year (8.78 lakh in FY22) amounting to a total active customer base of around 2.5 million and an asset book of INR 8,631 crore.

SME & Corporate Business: - Currently it is operating on 75 Locations on the non-retail segment. The team built a capacity to process 3,000 applications including EMI & No EMI loans in a month. In FY23, INR 7,572 crores worth of loans were disbursed during the year under review. It has closed the financial year with an impressive SME & Corporate asset book of Rs. 12,538 crores.

Borrowed Funds: - It has diversified sources of borrowings including debt market (non-convertible debentures and commercial paper), banks and financial institutions (term loans, working capital facilities and external commercial borrowings).

Borrowings and debt securities constituted 76.75% of funds employed at the end of FY23. Out of the total borrowings, Banks and financial institutions constitute 77.08% (term loans 58.32%, working capital facilities 6.44% and external commercial borrowings 12.32%), debt market constituted 22.92% (non-convertible debentures 13.04% and commercial paper 9.88%). It has a strong relationship with 36 banks/FIs including all PSU, major private and foreign banks.

The firm is working on to achieve their medium-term and long-term goals over a period of next couple of years by periodical reviewing risks, business continuity plan, liquidity management & enhancing quality of loan portfolio. To focus on digital initiatives to effectively service customers and to educate customers on the digital payment. It aims to grow to USD 10 Billion in assets & serve over 15 million customers by FY-25. It is also excited to strategically partner with the Munjal Family to support them in scaling their financial services business, one of the Hero Group’s leading franchises.

Hero FinCorp raised $267 Million (INR 2,000 Cr.) of Growth Capital from Apollo Global Management, Hero MotoCorp & others. With this capital infusion, the net worth of the company – which is rated AA+ by ICRA & CRISIL – will be INR 6,782 crore (USD 900 Million) on a consolidated basis.

Renu Munjal – Managing Director

Abhimanyu Munjal – CEO

Jayesh Jain - CFO

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111