HDFC Securities Limited (HSL), is one of India’s oldest stock broking firms, which offers a full-fledged investment service across asset classes, including buying and selling of equities, along with currency derivatives, mutual funds, NCDs, fixed deposits, bonds, basket investing, global investing, PMS/AIF and more ‒ to suit the diverse investment needs of an investors. It is a subsidiary of a leading Indian bank and biggest in terms of market capitalization - HDFC Bank limited. HSL has a network of 209 branches spread across 147 cities and towns along with dozens of digital centers. HSL has increased its customer base to 4.5 million.

| Description | H1-24 | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 |

|---|---|---|---|---|---|---|

| Revenue from Brokerage | 680.19 | 1,164 | 1,409 | 1,140 | 688 | 652 |

| Total Income | 1100.3 | 1,891 | 1,990 | 1,399 | 862 | 771 |

| PBT | 540.87 | 1,041 | 1,320 | 945 | 509 | 495 |

| PAT | 403.56 | 777 | 984 | 703 | 384 | 330 |

| EPS | 253.86 | 490 | 623 | 447 | 246 | 212 |

Major source of revenue comes from the following services -brokerage & fee income, investments & sale of services.

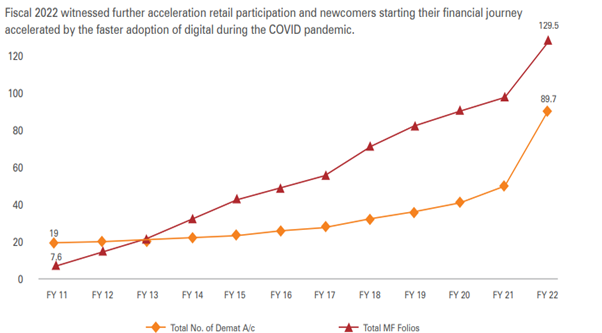

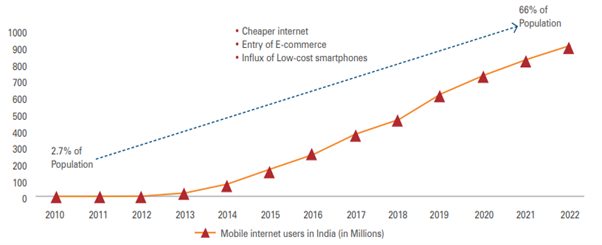

Indian economy is enjoying its glorious days & leading the economic growth race by far, amongst developed and developing nation. It is one of the largest economies (fifth) & currently hovering around USD 3.5 trillion & as per latest update India’s GDP growth rate is expected to reach 7.2 percent. At the same time local population which is around 1.4 billion and most of them falls under millennials age group, are all enthusiastic retail investors & subscriber for capital market products. This has been complemented well by the advancement of technology, availability of internet & financial awareness within the society. The Indian brokerage industry also benefited from this and has witnessed a massive turnaround in its business, starting from signing up new customers and taking them on board, witnessing overall growth in business volume, adding salient features like pick-up in flat brokerage model, local language. India has also been an undisputed leader in a trading derivatives contract in terms of volume from quiet sometime.

With the roll out of 5G technology and other digital awareness campaign run by the government & financial institutions helped them in boosting the investors’ confidence & bringing more clients. Also, regulatory measure & compatible digital platform helped in the higher penetration of the user base.

Ultimately, financial bodies which understand customers requirement & develop platform accordingly or adapt new one will be getting benefitted, while HSL seems to be covering most of the parameters by providing user friendly tools, advisory service & regularly updating & adding features like off market order (place after market hours), basket order (multiple scrips at a time), encash order (amount credited on the same day). Having a connection with prominent bank, it gives HSL extra leverage to connect with the wide customer base & provide them with add on solutions: banking & trading accounts (3-in-1 accounts), & post settlement operations. It has mitigated risk by investing in diversified investment policy across various asset classes: - invest in foreign market, NRI offerings, PMS/AIF, E-tax & e-will, NPS, equity, derivative, SIP, Corporates FD, NCD, IPO, mutual fund, etc.

Brokerage income is being considered as major organic source of core revenue stream & still accounts for a substantial proportion of revenue within the industry. With the debuting of new age brokers, who has been focusing on lower or fixed brokerage, has pushed the large incumbents gradually to diversify their portfolio offering with rising focus on value added services including advisory & research, financial planning and analysis, asset & wealth management apart from trading facility.

Brokerage firms dealing under various product lines has put an imminent cloud of uncertainty because of market risk, operational risk & compliance risk associated with it, along with that ongoing tussle with other banking brokerage competitors & new debutants in the market who are specialized in brokerage vertical only & using new technologies like block chain, AI etc.

The continued rise in derivatives volume especially from retail side has concerned SEBI, and it has thus tightened the rules for the same in order to ensure safety. Such tightening is expected to increase the cost for intermediaries, which will likely to lead out in the consolidation of the industry.

ICICI Securities, BNP Paribas Securities Pvt Ltd, Axis Securities, Kotak Securities, Zerodha, Upstox, Motilal Oswal, Angel Broking etc.

Dhiraj Relli - Managing Director and Chief Executive Officer

Kunal Sanghavi - Chief Financial Officer

Ashish Rathi - Whole Time Director

Sandeep Bhardwaj - Chief Operating Digital Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111