Elcid is a Non-Banking Finance Company which was incorporated in 1981. The shares of the Company are listed on the Bombay Stock Exchange (BSE).

The company is primarily an investment firm and its business income is the income arriving out of investments held by the company on various capital and money market products such as shares, debentures, mutual funds etc. The company is functioning under single segment of investment activities. The growing trend in the India’s economy is a motivating factor for the company to look forward to increase the profitability. The predominant risk pertains to investments including volatile capital market risks. The company regularly appoints and seeks advise from reputed portfolio managers to mitigate the risks and accordingly carry out its investments within the risk management framework.

The Company has two subsidiary companies viz. Murahar Investments & Trading Company Limited & Suptaswar Investments & Trading Company Limited. However, the Company does not have any joint venture or associate company.

| DESCRIPTION | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 | Mar-17 | Mar-16 |

|---|---|---|---|---|---|---|---|

| Gross Sales | 134.78 | 107.74 | 77.52 | 60.88 | 0.23 | 0.18 | 0.41 |

| PBT | 131.07 | 106.53 | 71.51 | 59.06 | 46.66 | 35.85 | 29.71 |

| PAT | 100.04 | 81.05 | 73.18 | 54.54 | 46.31 | 35.14 | 29.52 |

| Cash Flow from Operations | 61.10 | 14.10 | -1.16 | -0.92 | -0.86 | -1.26 | -0.35 |

| Cash Flow from Investing | -68.29 | -11.65 | 7.66 | 1.10 | 0.16 | 4.65 | 0.38 |

| Cash Flow from Financing | -0.30 | -0.30 | -0.36 | -0.36 | -0.36 | -0.12 | -0.30 |

| Current Ratio | 0.61 | 1.38 | 6.18 | 1.96 | 4.60 | 8.45 | 4.19 |

The company is an investment company hence, the ratios relating to sales, inventory are not applicable to the company.

The company is not having any debt, therefore the ratio relating to debt and interest comes to zero.

The total net profit before tax of the Company is Rs. 8,506.05 lakhs in current year compared to Rs. 7,201.93 lakhs in 2021. The Net profit after tax stood at Rs. 6,480.55 lakhs as compared to Rs. 5,488.66 lakhs in 2021. With the growing markets the Company is also expected to grow and the future prospects are expected to be better with the booming economy of the Country.

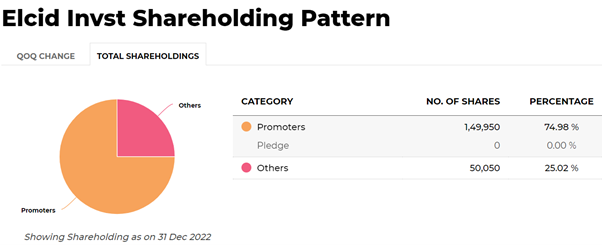

The Company has only one class of equity shares having par value of Rs. 10 per share. The company is an NBFC Investment company and part of promoter group of Asian Paints Ltd.

Varun Vakil - Non-Executive Chairman

Dipika Vakil Non-Executive Director

Amrita Vakil Non-Executive Director

Market Cap: Rs 3,000 to 3,200 Crore

Face Value: Rs 10 per share

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111