Ixigo is an OTA (Online Travel Agency) platform focused on empowering travelers to plan, book and manage their journey across rail, air, buses and hotels. They assist traveler by safeguarding and making better travel decisions plans by leveraging over new tech driven ecosystem artificial intelligence, machine learning and data science led innovations on their OTA platforms, comprising their websites and mobile applications. It has a personalized travel assistant TARA, which is powered by deep learning. This boosts the confidence of the user and makes a memorable experience for them.

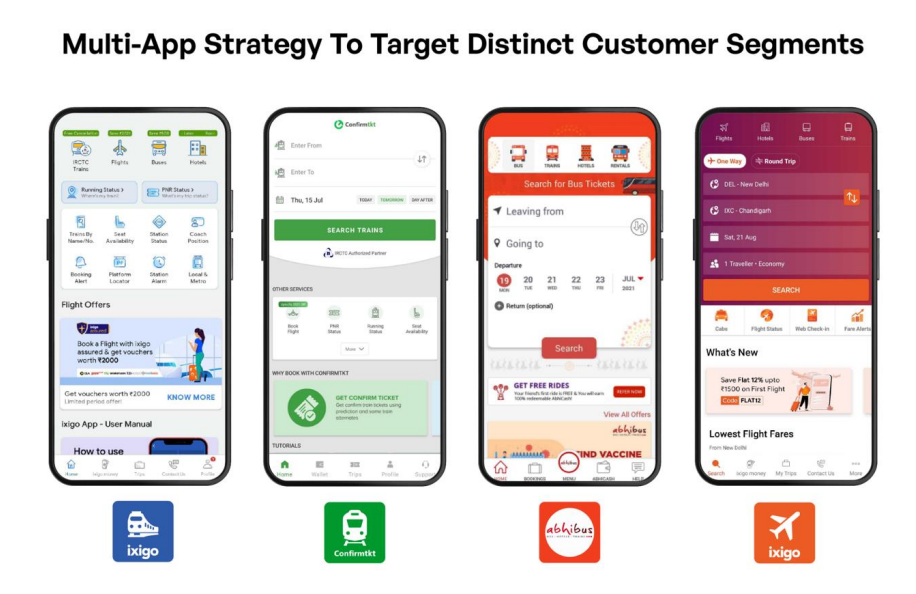

Ixigo understood the importance of Indian Railways and its significant role in a domestic market which averaged at 24 million passengers on a daily basis, & thus strategically acquired ConfirmTkt, a fast-growing train-focused business, which has seen a spike in revenues from their ticketing verticals. In FY22, they also acquired the bus business of AbhiBus, effectively becoming the second-largest bus OTA in India. With all this they formed a synergy in selling tickets of buses, trains, and flights across the entire group of users operating from all tier cities in India. These acquisitions helped them to mint substantial revenue from the bus & rail ticketing.

With the use of advance technology and customer centric user interface and support centre, 85% of their customers joining them organically every year. All these steps have helped them in becoming the most downloaded OTA app.

Ixigo launched several products with different features like ‘Ixigo Flex’ a product that offers travellers a one-time rescheduling request at a nominal price, ‘Assured Flex’ that offers traveller to avail the benefit of free cancellation.

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Total Income | 517.58 | 384.94 | 138.41 | 112.99 |

| EBITDA | 45.05 | -6.96 | 6.14 | -23.8 |

| PBT | 33.29 | -17.6 | 8.21 | -26.61 |

| PAT | 23.4 | -21.09 | 7.53 | -26.61 |

| EPS | 0.57 | -0.66 | 0.26 | -151.24 |

Revenue is mostly made from the services that Ixigo offers such as: ticketing, advertising & facilitation.

With the rise in overall tourism industry & ease at which hospitality sector bounced back on track post pandemic has given a new lease of life to all the players involved in it. Having said that easy access to internet and smartphones played a big role in rising demand of an OTA platform which boosted the overall growth. This also help the likes of Ixigo & other facilitator to gain the momentum and add more active user base. Ixigo also performed way better than its peers during tough covid times and also managed to reduce the custom acquisition cost despite increasing the new customer base on year-to-year basis.

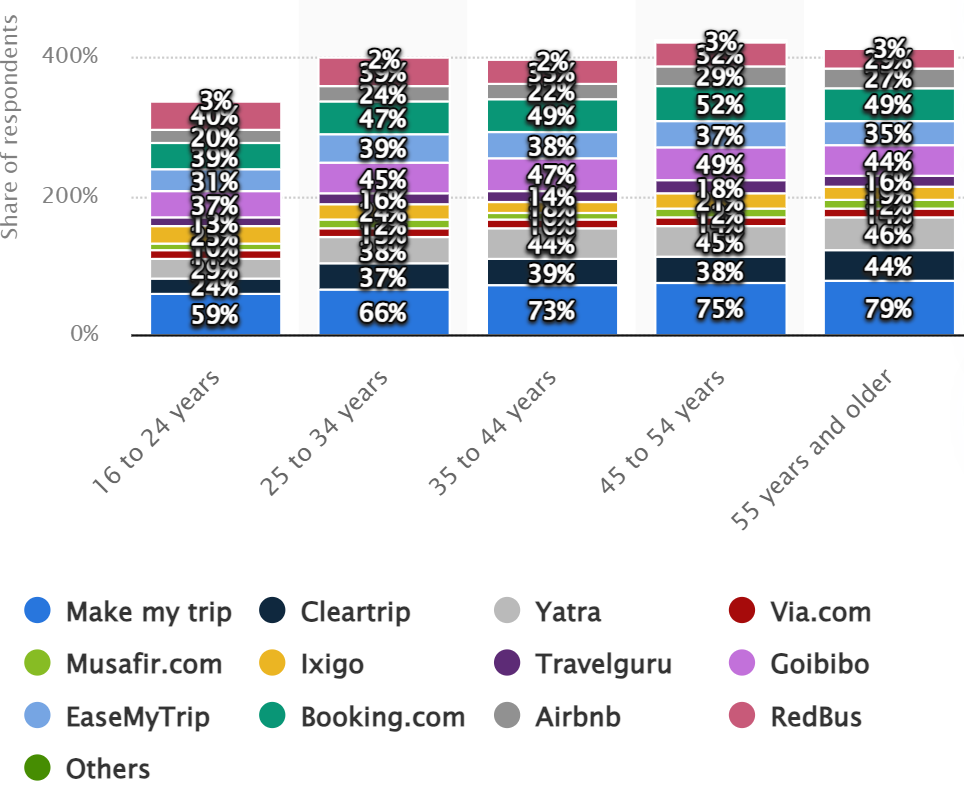

The biggest hurdle for an OTA player arises with new entrant by the domestic and foreign players hovering over an OTA market which makes things very interesting for the loyal user base whether they will stick around with the former or opt for the latter. Also, the customer base engaging with different OTA platform based on the offerings will bring up interesting time ahead. However, the major roadblock for the industry is that market is still dominated by the non-OTA players across India which will be hard to penetrate in near future.

With the clear intention of going public, it will soon be coming up with an initial public offering.

SAIF Partners, SCI Investments, Gamnat Pvt, Aloke Bajpai, Rajnish Kumar, Micromax.

Aloke Bajpai – Co-Founder & Group CEO

Rajnish Kumar – Co-Founder & Group CPTO

Rahul Gautam – Group CFO, Ixigo

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111