Godavari biorefineries is a typical refinery which has ability to convert sustainable and renewable resources to produce chemicals. Chemicals and sugars contribute large portion of their product portfolio which contributes about two third of their business and furthermore can add more growth opportunity. They are working on their new specialty chemical to make customization for further expansion. Godavari is strategizing to add more value on their feedstock. From a biorefinery perspective, it is of particular interest to use microorganisms to produce chemicals and energy carriers.

Bhumilabh, Sugar, Alcohol, Sand,Waxes, Chemical, Renewable Energy, Jivana , Hand sanitizer

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

|---|---|---|---|---|---|---|

| Revenue from Operations | 2,014.69 | 1,702.33 | 1,538.17 | 1,459.14 | 1,552.22 | 1,246.66 |

| Total Revenue | 2,023.07 | 1,709.97 | 1,546.38 | 1,472.79 | 1,566.32 | 1,253.02 |

| EBITDA | 154.13 | 141.02 | 93.60 | 49.10 | 56.19 | 38.08 |

| PBT | 31.26 | 32.55 | 46.32 | 3.29 | 6.38 | -27.05 |

| PAT | 19.27 | 19.46 | 27.15 | 4.06 | 5.54 | -19.08 |

| Cash Flow from Operations | 193.85 | 45.31 | 148.72 | 249.56 | 287 | 62.43 |

| Cash Flow from Investing | -213.42 | -46.63 | -7.49 | -22.60 | -54.57 | -28.21 |

| Cash Flow from Finance | 30.81 | 4.46 | -139.11 | -226.44 | -231.17 | -36.06 |

| Debt Equity Ratio | 3.03 | 2.71 | 0.70 | 0.74 | 0.77 | 0.78 |

| Current Ratio | 1.05 | 1.06 | 1.08 | 0.74 | 0.75 | 0.74 |

| EPS | 4.60 | 4.64 | 6.47 | 1.11 | 1.46 | -5.16 |

| Divisions | 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 | 2017-18 |

|---|---|---|---|---|---|---|

| Sugar | 679.78 | 520.37 | 493.15 | 626.64 | 632.05 | 543.84 |

| Cogeneration | 42.85 | 36.32 | 40.52 | 41.47 | 33.56 | 36.46 |

| Chemicals | 645.79 | 643.5 | 536.44 | 454.18 | 609.2 | 481.69 |

| Distillery | 631.86 | 490.61 | 456.16 | 326.49 | 260.7 | 156.03 |

| Total | 2000.28 | 1690.8 | 1526.26 | 1448.78 | 1535.51 | 1218.02 |

The production capacity for ethanol blending has increased significantly, along with availability of multiple starch based raw materials & their diversion taking place for blending purposes because government of India initiative & pragmatic stance to push for the production of ethanol fuel blending using sugarcane or B- heavy molasses. The GOI is strongly encouraging and monitoring the programme to have 20% blending by 2025. Society of India Automobile Manufacturers (SIAM) has informed the Indian Sugar Mills Association (ISMA) that Indian automakers have started making E20 ready cars and are further targeting the manufacturing of flex fuel vehicles in upcoming years.

Chemical division of Godavari which contributes almost one third of overall revenue is working on diversification for their specialty chemical base. At present major contribution comes from Ethyl Acetate is 49.25%, whereas the share of specialty chemicals is 50.75%. With tremendous growth in Indian economy due to persistent demand and overall consumption along with all the sectors firing at all cylinders, the firm’s future looks in good shape considering the product base & heavily relying on domestic market.

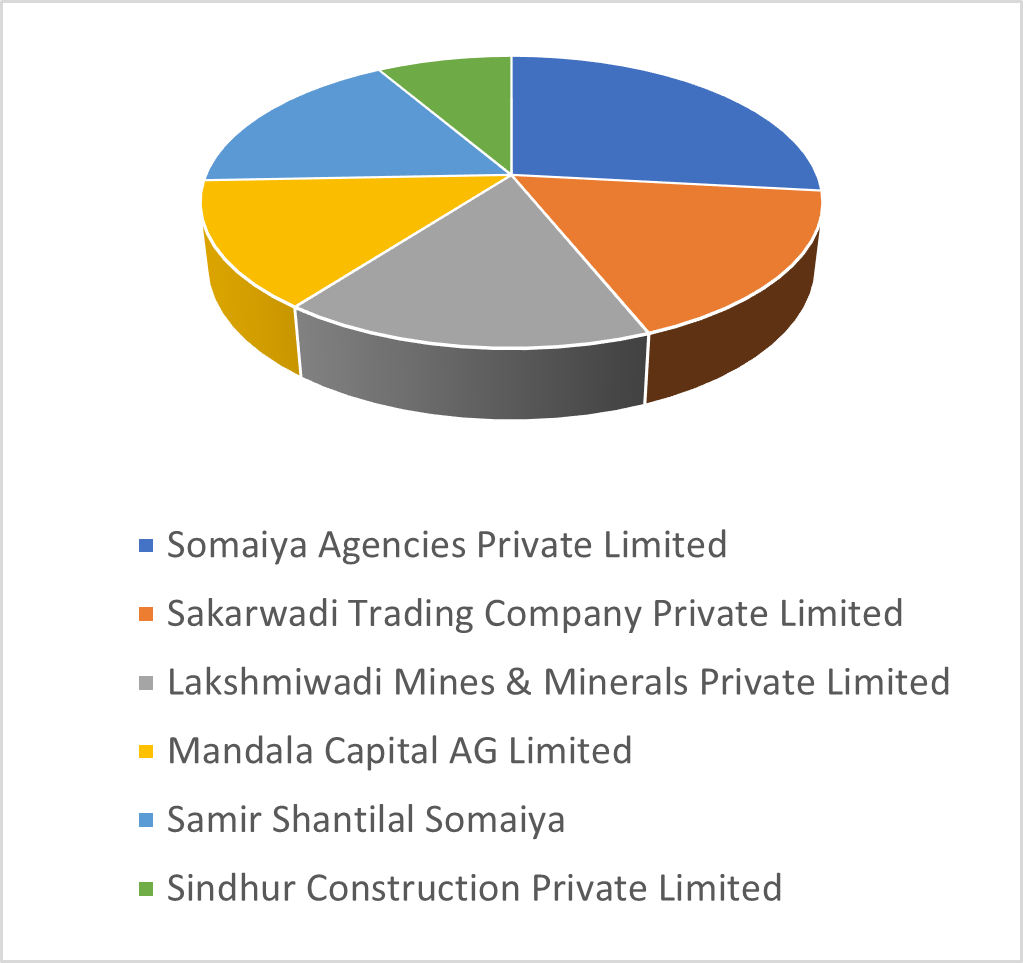

| Shareholders | Percentage |

|---|---|

| Somaiya Agencies Private LTD | 22.3 |

| Sakarwadi Trading Company LTD | 14.34 |

| Lakshmiwadi Mines & Minerals Private LTD | 13.64 |

| Mandala Capital AG LTD | 11.75 |

| Samir Shantilal Somaiya | 14.36 |

| Sindhur Construction Private LTD | 6.99 |

Samir Somaiya – Chairman & Managing Director

Naresh Khetan – Chief Financial Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111