ESL Steel has established excellence in every stage of production using their core expertise in managing plant fields and bringing in solutions from reputed manufacturers across the country. In less than one year after assuming operations, ESL Steel underwent a positive transformation resulting in a profitable business. It is aiming to scale up their steel operations in Bokaro through brownfield expansions and be amongst the top steel producers in the world.

ESL was incorporated as a public limited company in 2006 and had operations in Bokaro, Jharkhand. As an integrated steel producer, it has undertaken a greenfield manufacturing facility with a capacity of 1.5 million tonnes per annum. The product range of the firm includes pig iron, billets, TMT bars, wire rods, and ductile iron pipes.

Vedanta entered the steel business by acquiring a 90% stake in ESL Steel Limited in 2018.

Current capacity of 1.7 MTPA hot metal production and an expansion plan underway to enhance the capacity to 3 MTPA steel production. In FY23, it has achieved the highest ever hot metal production of 1.367 MT up 1 % Y-O-Y and highest ever saleable production of 1.284 MT up by 2% Y-O-Y. However, the EBITDA margins have contracted by 56% Y-O-Y mainly due to rapid dynamic price changes in both input commodities and finished products, there was abnormal surge in international Coking Coal prices in the beginning of the year.

In addition to that Government of India in mid-2022, had imposed export duty on certain products- Pig iron, TMT & Wires rod and increased export duty on all grades of iron ore. However, the same has been withdrawn by the Central Government later that year and restored status quo, which resulted in better performance in Q4.

| DESCRIPTION | Mar-23 | Mar-22 | Mar-21 | Mar-20 | Mar-19 | Mar-18 |

|---|---|---|---|---|---|---|

| Total Income | 8052.28 | 6799.84 | 4899.23 | 4481.15 | 5006.98 | 3677.28 |

| PBT | -470 | 24.20 | -21.81 | -21.81 | 1186.80 | -6138.85 |

| PAT | -557.9 | -94.59 | 2732.01 | -21.81 | 1186.80 | -6138.85 |

| Cash Flow from Operations | 954.53 | 1551.42 | 78.44 | 672.90 | 854.12 | 1039.52 |

| Cash Flow from Investment | -39.9 | -742.82 | 509.67 | -366.57 | -238.27 | -649.35 |

| Cash Flow from Financing | -943.7 | -865.31 | -638.07 | -492.46 | -278.44 | -443.38 |

| Debt to Equity | 0.47 | 0.51 | 0.53 | 1.02 | 1.92 | -1.48 |

| Current Ratio | 0.66 | 1.00 | 1.46 | 1.57 | 1.86 | 0.13 |

Return on equity for FY23 period was -10.02% from -0.59% due to increase in price of principal inputs.

Return on Investment was 14.57% in FY23 from 3.55% due to volatility on financial products.

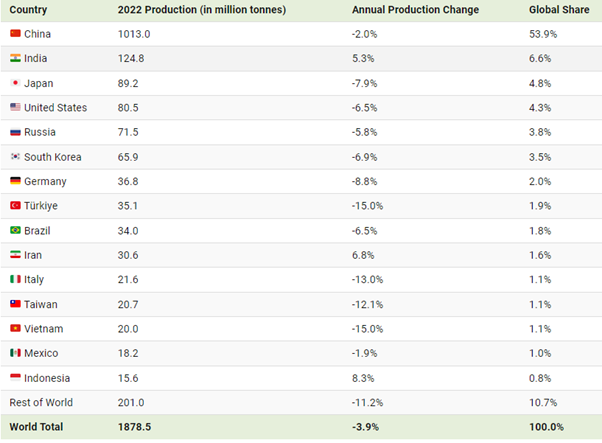

The Indian steel sector has grown rapidly over the past few years and presently it is the second largest steel producer globally, contributing to about 2% of the country’s GDP. India has also crossed 100 MT mark for production for sale in 2016-17.

The New steel policy on aspires to achieve 300MT of steel-making capacity by 2030. This would translate into additional investment of Rs. 10 lakh Crore by 2030- 31. This is pushed by increasing the consumption of steel in various sectors like infrastructure, automobiles and housing & Central government bringing Production-Linked Incentive (PLI) Scheme for specialty steel with an outlay of INR 6,322 Crore to promote the manufacturing of specialty steel within the country.

Prasun Kumar Mukherjee – Chairman

Ashish Kumar Gupta – Chief Executive Officer

Anand Prakash Dubey – Chief Financial Officer

For any queries, reach out to: unlisted@rurashfin.com or Call: +91 224157 1111